By Joe Azzinaro, Consumer

If a food product has an international flair, Americans—particularly Millennials and Gen Zers—love it. These are products that are marketed by grocery retailers with a clear international character and orientation and are made domestically or are imported and are store brands as well as national brands.

In large numbers, US consumers of all ages are highly aware of the international products in their favorite supermarket or food store, can easily identify the products’ country of origin, are buying more of them than they were five years ago, are willing to try the products for the first time, and want to see more of them on their shelves, according to a new survey conducted by Surveylab, a global leader in customized online research. The findings were provided exclusively to Global Retail Brands by PLMA.

The 2020 survey also documents that consumers have strong opinions about the product qualities and features that appeal to them and that they demonstrate a strong willingness to buy international food products for the first time. Younger generations who participated in the survey – Millennials and Gen Z – were shown to be even bigger fans of international food products than the test group as a whole.

Respondents were also asked a series of similar questions about their awareness of and attitudes towards international non-food products, such as health and beauty products like perfume, cosmetics, and hair care; and household and kitchenware, among others, that are available in a wide variety of their favorite stores.

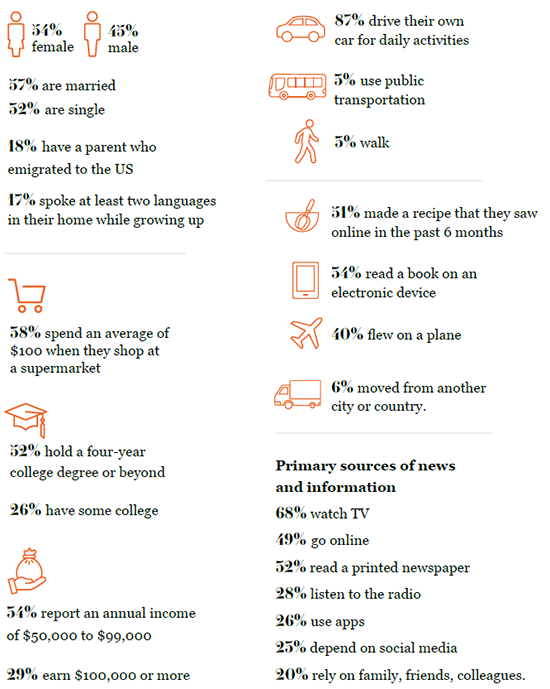

The study involved some 800 women and men from throughout the US who identified themselves as the principal grocery shopper in their household.

International Food Products

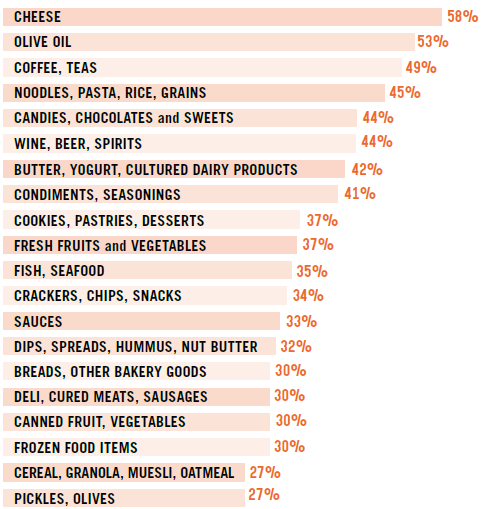

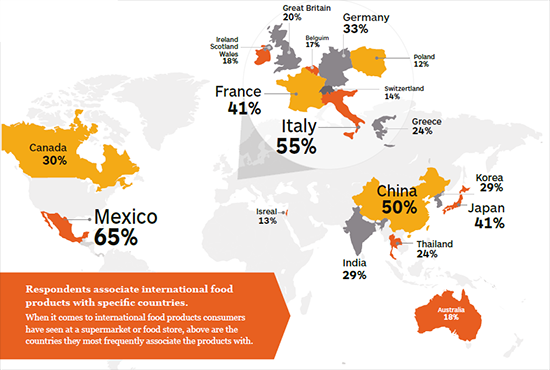

Many international food items are familiar. Among international food products that consumers have seen offered at a supermarket or food store, the most often cited were

Consumer awareness of international food products is high. More than eight of 10 (82%) consumers in the study said they are aware of international food products that are sold in their favorite supermarket or food store. The figure is slightly higher among Millennials in the study, at 87%. Only 4% of all respondents reported that their stores do not offer international food products.

A majority of shoppers say they can identify the country of origin of all the food products in their supermarket.

73% of Millennials and Gen Zers, say they are aware of the food products’ origin.

56% said they are aware of the country where all of their supermarket’s food products are grown, Product assortment is seen as growing.

46% said that compared to five years ago there are now more international food products available in their favorite supermarket or food store.

28% said there is the same number available in their store.

Consumers want more international products in their stores. More than one third (35%) would like to see their favorite supermarket or food store offer more international food products. The number who want more of them is higher in younger groups in the study: Gen Zers (56%) and Millennials (50%).

Many say international products priced higher than their domestic counterparts. Four in ten (38%) said international food products are generally are priced more than similar domestic food products in their favorite supermarket or food store. One in four (27%) said international food products are priced about the same; one in five (19%) said the pricing varies.

Most consumers are willing to try international food products. A majority (54%) said they are willing to buy an international food product for the first time when they are shopping in their favorite supermarket or food store. Another 33% said they are somewhat willing to buy a product for the first time. Three of four (72%) Millennials and two-thirds (64%) of Gen Zers in the study are willing to buy them for the first time. Only 8% overall said they are not willing.

Products are purchased often.

27% always or frequently purchase an international food product when they do their regular grocery shopping at their favorite supermarket or food store.

46% Millennials

35% Gen Zers buy international food products at that rate when they shop.

43% said they buy at least one or two international food items when they shop

22% said they buy three or more food items each time they shop.

One-third buy international food products online. Three in ten (31%) of all consumers in the study said they frequently/occasionally purchase an international food product of any kind online. Among younger generations in the study the degree of online purchase of an international food product increases sharply: to 53% of Gen Zers and 51% of Millennials. At the other extreme, only 14% of pre-boomers and 16% of boomers buy them at that rate. In response to a separate question, 40% of all in the study (and 61% of the Millennials) said they ordered food online from a restaurant or supermarket in the previous six months.

Many consumers are buying more. Compared to five years ago, one third (31%) said they are now buying more international food products when they do their regular grocery shopping. Again, among younger generations, the number who are now buying more international food items vs. five years ago runs higher: Millennials (at 46%), Gen Z (43%). Half of all in the study (51%) said they are buying the same number.

International food products are often purchased in other channels. Besides their favorite supermarket or food store, consumers also buy international food products at other types of stores, including mass merchandisers (cited by 38%).

specialty food stores 30%

club stores 28%

low price stores 21%

neighborhood ethnic stores 20%

dollar stores 5%

local specialty food stores 14%

farmer’s market 12%

Taste is paramount. The features of an international food product that consumers find appealing when they are considering its purchase include

taste 69%

quality 48%

authenticity 36%

exotic flavor 33%

uniqueness 28%

packaging 19%

size or amount 19%

unusual ingredients 16%

performance 12%

Recommendations are top influencers. The leading influences that encourage a consumer to buy a particular international food product for the first time include the recommendation of family or friend (39%), the desire to try something new (37%), value for the money (35%), they tasted it at an ethnic or international restaurant (25%), they sampled it in the store (25%), they bought and enjoyed other products from the brand (25%), they saw it on a TV food show (24%), trust in the supermarket or food store (24%), country of origin of the product (24%), and trust in the supermarket or food store that is selling the product (24%).

Flavor and quality encourage consumers to repurchase. The top reasons that encouraged consumers to repurchase a particular international food product were flavor (54%), quality (42%), overall satisfaction (41%), value for the money (37%), ingredients (26%), and authenticity (24%).

Consumers express some concerns. Among the concerns they have before they buy an international food product, respondents most frequently cited price (39%), quality (34%), overall product safety (30%), ingredients (25%), and pesticides or environmental impact (25%). Twelve percent had no concerns.

Retailer store brands are well-recognized. When they shop for international food products, six in ten consumers (59%) in the study said they are aware of the retailer store brand that the products carry. Younger groups demonstrate an even greater awareness of the retailer’s store brand: Millennials (74% are aware) and Gen Zers (67%). In a related question, half (49%) replied that when they shop for international food products, they are aware of “any brand” that they carry; Millennials were more brand conscious, two thirds (66%) said they were aware of any brand.

There is plenty of evidence from other industry sources that supports the finding of how strongly Americans, young consumers in particular, feel about international food products.

“Gen Z is cultivating an appreciation for international cuisine from a young age. Some 36% of parents of children under age 18 agree their kids enjoy eating international foods,” says Mintel.

“Interest in international cuisine goes well beyond commonplace varieties such as Italian, Mexican and Chinese. Gen Z consumers are driving consumption of more emerging international food and drink.”“In addition to eating at restaurants such as Indian, Middle Eastern or African, Gen Z consumers are also much more likely than older generations to find culinary inspiration from social media: 62% say they cook international cuisines at home from social media, compared to 46% of Millennials and 23% of Gen Xers.”

“With early exposure to international foods, Gen Z is more likely to be open to the latest food trend or innovative fusion creation. These adventurous habits create opportunities across categories, presenting potential for products like tikka masala meal kits or Peking duck-flavored potato chips. While restaurants remain the most common points of discovery, their exposure to a range of food should inspire supermarket brands to offer more authentic and hybrid international flavors,” adds Mintel. “Gen Z has the potential to reset expectations for health and wellness, increase the reach of international cuisine and heighten creativity in the kitchen.”

NPD points out: “A large percentage of Gen Z was raised to put a greater emphasis on the quality of food, whether it’s clean, fresh, or nutritionally beneficial, as well as its flavor and function. Their attitudes and behaviors about foods they consume are being reflected across grocery shelves and cases.”

“A diversifying consumer base and more global travel continues to produce adventurous consumers. People are more willing to try new foods and flavors. New product launches are being inspired by global foods and spices such as za’atar,” says Virginia Lee, of Innova Market Insights.

Social media is connecting them to their plates and giving the individual consumer the ability to not only share what’s on their plate, but also a platform through which to communicate with brands, companies and even participate in the food development process. This points to an empowered and connected global consumer who is demanding more authenticity and story, varied alternatives, and a stake in sustainability and bettering the world, continues Lee.

The international food trend is playing out in US foodservice, as well. According to a Technomic study, one third of people eat ethnic food at least once a week and a third are willing to pay extra for authentic ethnic fare. Consumers continue to expand their palates, seeking new ethnic foods and flavors. This trend is pushing operators and suppliers to add new, exciting ethnic varieties on menus, but they must also be mindful of consumer preferences and demands when doing so.

They want to be informed about ethnic options to ensure their expectations of authenticity—a term that changes meaning per person—are met. Indicators of authenticity can vary widely, from native chefs/cooks to imported ingredients and bold flavors. By offering transparency upfront, the customer can decide if the dish fits their take on authentic.

“Everyone’s definition of authentic is different, so when it comes to ethnic fare, it’s vital to clarify the flavor profile and ingredients upfront so consumers aren’t surprised or disappointed in their order,” explains Kelly Weikel, of Technomic. “Additionally, ethnic options must feel accessible rather than intimidating and this can be achieved through providing flavor and sourcing information about each ethnic dish.”

Among all consumers who ever order ethnic fare or food with ethnic flavors, 32% would be willing to pay extra for authentic ethnic fare, 44% always prefer completely authentic fare, 23% say their preference changes based on the cuisine and 36% like to explore regional varieties of mainstream ethnic cuisines to try new foods and flavors, reports Technomic.

As social media and travel shrink the world and blur borders, American consumers are gaining glimpses into different regional kitchens, an insight which has prompted them to seek to recreate ethnic cuisines in their own homes, offers Food Dive.

As consumers become more familiar with global flavors, they are beginning to demand more for their palates. While yogurt, sushi, hummus and tahini were once considered exotic additions to a dish, now they are commonplace ingredients that many consumers thoughtlessly select from a grocery shelf as part of their weekly shop.

“We’re seeing a lot of foods that have become part of the fabric of what ‘food’ means,” says Mintel’s Melanie Bartelme. As people have come to the U.S. and shared their cuisines, these flavors become wrapped up within ‘American’ food and take on a life of their own.”

International Non-Food Products

The survey participants w ere also asked about their awareness of and attitudes towards international non-food products in their favorite store. Examples of such products include health and beauty items like perfume, cosmetics, and hair care; and household and kitchenware, among others.

Majority are aware of international nonfood products. Half (50%) of the consumers in the study said they are aware of international nonfood products that are sold in their favorite supermarket, drug store, mass merchandiser, club store, department store, specialty health and beauty store; or home décor or home improvement store, among others. In younger groups the awareness level was higher:

58% of Millennials

70% of Millennials are aware of the products.

They know the origin of non-food products. When they shop in a supermarket, half (47%) said they are aware of the country where the all of the store’s non-food products – personal items, kitchenware, housewares – are produced or manufactured. Two-thirds (64%) of Millennials in the study said they are aware of the non-food products’ country of origin.

International non-food products in the store are identified. Among the international non-food products respondents reported their stores offer, the most often cited were: kitchenware, such as cookware and bakeware, utensils (31%), consumer electronics and technology devices (31%), beauty and personal care products, such as soaps, skin care (31%), perfume, cologne (29%), housewares and small household appliances (27%), hair care (25%), health and wellness remedies (24%), cosmetics (23%); eyewear, sunglasses (20%), furniture (20%), and men’s grooming products (15%).

More non-food products are available now. Compared to five years ago, 33% said there are now more international non-food products that are available in their favorite store. Another third said there is the same number of products.

Consumers want more of them.

24% would you like to see their favorite store offer more international non-food products.

59% Millennials

49% Gen Zers

want to see more of the products in their store.

One in four say price is higher than domestic counterparts. International non-food products are priced more, when compared to similar domestic nonfood products in their favorite store, according to 26% of the respondents. About one third (31%) said international non-food products are priced about the same.

Half of respondents describe themselves as willing firsttime buyers of the products. Nearly half (45%) are willing to buy an international non-food product for the first time when they are shopping in their favorite store. Another 39% said they are somewhat willing to do so. Fully 60% of Millennials in the study expressed a willingness to buy the international non-food products for the first time.

International products are purchased often in the store. One in five (19%) purchase an international non-food product always/ frequently when they are shopping at their favorite store. Among Millennials, the figure is 39%.

Non-food products are bought online often. Four in ten (38%) always/frequently purchase an international non-food product of any kind online. Six of ten (59%) Millennials and half (52%) of Gen Zers in the study buy the products online at that rate, compared to pre-boomers (22%) and boomers (28%).

Consumers are buying more international non-food products. Compared to five years ago, 22% in the study (and 31% of Millennials) are now buying more international non-food products when they are shopping at their favorite store. Half (53%) are buying the same number.

Non-food products are purchased in many types of stores. As for the types of stores in which consumers have purchased international non-food products, the leading channels cited are:

mass merchandisers 42%

online sites, such as Amazon 34%

supermarkets 27%

club stores 24%

department stores 22%

dollar stores 21%

housewares stores 20%

home improvement stores 19%

Quality tops features that appeal to shoppers. The features of an international non-food product that consumers find appealing when they consider purchasing it are led by:

quality 56%

authenticity 32%

uniqueness 31%

performance 30%

Personal recommendation is top influencer in buying a product for the first time. Among the influences that encourage a consumer to buy a particular international non-food product for the first time, the list was led by:

Recommendation from family or friend 52%

value for money 48%

saw item on TV 28%

want to try a new item 25%

trust in the store 22%

and trust in the brand 22%

Quality is chief factor in the repurchase of products. When it comes to what reasons encourage a shopper to repurchase a particular international non-food product, top factors were:

quality 48%

value for money 42%

overall satisfaction 39%

performance 30%

trust in the brand 23%

Some concerns on non-food products were expressed. Respondents expressed some concerns before buying an international non-food product, such as:

quality 42%

price 38%

product safety 37%

have no concerns 12%

More than half of consumers are aware of the retailer’s store brands. When they shop for international non-food products

53% said they are aware of the retailer’s store brands.

64% of Millennials say they are aware of them.

b in the study replied that when they shop for international non-food products, they are aware of “any brand” that they carry

60% Millennials were more brand conscious and were aware of any brand.

Demographics of the Study

This study was conducted by SURVEYLAB (www.surveylab.co.uk/), commissioned by the Private Label Manufacturers Association (www.plma.com) and provided exclusively to Global Retail Brands for publication.

The demographics of the 800 respondents are: