By Sebastian Rennack Senior Retail Analyst, LZ Retailytics

End of a Golden Age

Discounters in Poland are increasingly evolving their formats towards the supermarket model. But not all of the key players – Biedronka, Lidl, Aldi Nord and Netto – will be able to keep up with shifting consumer preferences. With shoppers expecting a broader choice of branded items and higher product quality, all channel players have increased their SKU count by up to 50% in recent years. As a result, the latest store concepts are more advanced than in many Western countries. The larger share of branded items has made the discount model vulnerable to promotional attack from other channels. Therefore, market leader Biedronka and follower Lidl are working to reinvent their sales concepts in a head to head race, while simultaneously battling for price leadership. Long-established Aldi Nord, the latecomer in this new game of supermarketisation, is moving fast, but without a realistic chance to gain a position of importance at a national level.

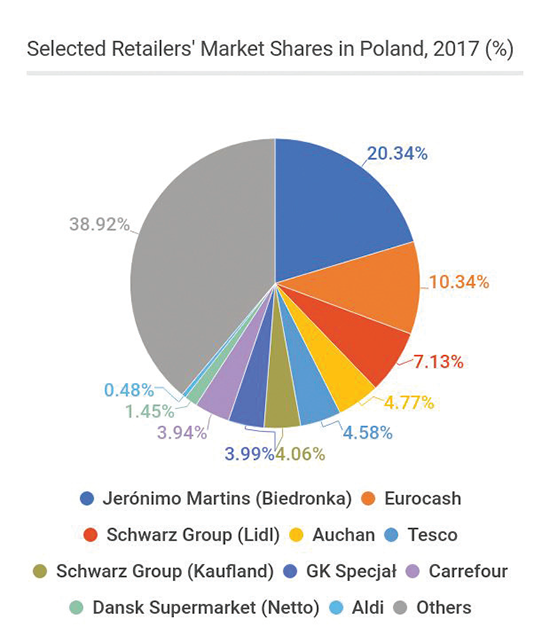

The golden age of hard discount in Poland is over. With disposable income growing, consumers not only expect to find the lowest prices instore at key players Biedronka, Lidl, Aldi and Netto, but increasingly attach importance to product quality, including a better choice of branded goods. Currently discounters make up almost 30% of organised grocery retail in Poland, with the channel taking the largest share of the market. With annual growth rates of almost 9%, the price oriented format has been distinctly outperforming the market by more than five percentage points over the last couple of years.

This has come at the expense of the hypermarket segment and independent traders. Increasing consolidation, geographical saturation and shifting shopper preferences, however, will curb future expansion and challenge the discounters’ basic business model.

Biedronka, the undisputed market leader with a store network of more than 2,700 soft-discount stores nationwide, is increasingly under attack from much smaller Lidl. The German discounter not only offers competitive prices, but its strong focus on quality and freshness is making up for a store count that barely reaching 600 outlets. Global heavyweight Aldi and Danish Netto constitute only a minor presence, with insufficient stores to be able to measure up to the top player currently. With the total number of discounter outlets expected to approach 4,000 stores within the next two years, continued growth runs the risk of increasing cannibalisation and consequently, sinking profitability. Where in the past new store openings guaranteed a positive like-for-like by taking market share from other market participants, now the discount players are battling primarily amongst themselves.

Upmarket Evolution

With disposable income in Poland rising, the four discounters are in the process of adapting their sales concepts to evolving customer expectations. Although promotional battles between Biedronka and Lidl are still prominent, consumers’ reorientation towards purchasing criteria such as quality, local origin and convenience are driving strategy changes.

Biedronka’s store network covers rural as well as urban areas all over Poland. Adapted to local catchment areas, Jerónimo Martins’ discount banner ranges from 400 to 900 sq m. Seasonal pallet placements in front of the checkout zone as well as selling residual non-food items under the ‘Towaroteka’ banner partially compensate for this disadvantage.

In a country in which a large part of the population is based in rural areas, with strong and deep-rooted traditions, the standard, international no frills approach of ‘one size fits all’, however, no longer works. This is where Biedronka’s singlemarket operation and size has paid off to date. Where Aldi and Lidl featured up to 85% phantom brands unknown to the Polish consumer, Biedronka scored goodwill with its customers by offering significantly more branded items of Polish origin at better prices. But now it feels like the tide might be turning.

Sales Concepts

Converge Mutual copycat tactics for seasonal promotions; international weeks; and time-limited premium food and non-food own brand offers have been blurring the differentiation between the two market leaders, who are fighting to maintain a distinguishable USP. Seeking defining features other than pricing, both retailers promote their fresh ranges and product quality. Biedronka’s fruit & vegetable concept Warzywniak (‘Fruit & Vegetable Stall’) is poised against Ryneczek Lidla (‘Lidl’s Open Market’). Meanwhile in the bakery, Biedronka’s Swieze Wypieki (‘Fresh Pastries’) compete with Chrupiace z Pieca (‘Crispy From the Oven’); and at the meat chiller Kraina Miesa (‘Land of Meat’) attempts to entice customers versus Lidl’s Rzeznik (‘Butcher’).

Essentially these efforts are all directed at creating traffic and increasing customer loyalty in high involvement categories. Finally, celebrity marketing and the tentative listing of regional products are both strategies aimed to strengthen local anchoring, while at the same time reflecting an increase in patriotic awareness.

Biedronka, already leading with regards to Polish brands, has regionalised its weekly offers and unmistakably defends its claim as a Polish-origin discounter with marketing campaigns such as ‘My Polacy uwielbiamy grillowac’ (‘We Polish love to barbecue’). So far Lidl, taking the role of David, is holding its ground against ever-present Biedronka, D the Goliath in this analogy.

A Discounter for the Elderly

At the same time, we see market follower Netto (Dansk Supermarked) going its own way. The refurbishment of its stores to its latest international concept is clearly directed upmarket. However, the massively promoted ‘Pólka Zdrowia’ (‘Health Shelf’), which takes up five units in the new store concept, might not be aimed at the Danish banner’s primary target group. In our opinion, Netto has taken the role of proximity discounter for the elderly generation.

The bakery range consists of mainly white bread and Kaiser rolls, the butcher in front of the checkouts offers traditionally smoked sausages and cured pork. Also, half of the large range of chilled butters and margarines are designated for baking – not necessarily the pastime of the younger generation. The large selection of TV magazines at the checkout reinforces this impression. This does not mean that Netto is taking the wrong path. The retirement age in Poland was reduced recently; meanwhile the 60+ age group in the country is expected to grow fastest until 2020. With novel items such as coconut oil and Himalaya salt added successively, Netto prepares for the future while catering to a key demographic segment.

Aldi Joins the Game

It is no longer an option for Aldi Nord to stick to its minimalist EDLP policy while handling its marketing communication with elegant reserve. Increasing its SKU count by more than 50% over the past few years, as is the tendency for all market players, the German discounter has recognised that it must follow the market to keep pace with its much larger channel peers, investing in marketing communication and listing more brands. In a price-driven, but increasingly quality oriented market environment, the retailer is following the supermarketisation trend.

As a result, the discount veteran exposes itself to heightened price transparency, now competing on an equal and comparable basis against all other market players. Taking the bull by the horns, Aldi is stepping up its game on every level.

Aldi Nord’s stores until recently conveyed an atmosphere of simplicity accompanied by a touch of sterility. Following recent changes in signage, weekly promotions and the non-food sales area offering price reductions of 30%-50% has all increased visibility. Judging from the increased customer traffic, price oriented marketing communication has been a success for the traditionally rather tight-lipped German discounter.

Leaflets have been restyled and are now called ‘Aldi Hity Tygodnia’ (‘Aldi Hits of the Week’) with the last page ‘Nowosc!’ (‘Novelties!’) primarily reserved for supplier brands. Promotions instore are presented in a designated area marked ‘Super Cena’ (‘Super Price’), enhanced with appropriate signage; and the non-food section now features a ‘Wyprzedaz (‘Sales Reductions’) zone. Also from the outside, changes are clearly visible, with exterior walls featuring promotional as well as image billboards.

German Discounters Prove Staying Power The new-found importance of Poland as a market for international operators Lidl and Aldi is indisputable, even if both feature a global network of more than 10,000 stores each. Both are allocating considerable sums to store refurbishment and new shop designs. Aldi Nord just authorised a budget of EUR5bn to refresh its operations right across Europe. The time when discount stores in Poland were reminiscent of German shops twenty years prior is over. The latest urban concepts such as that recently opened in Poznan seem noticeably more modern and innovative than many long-standing siblings located in our neighbour country to the West.

Netto’s refurbished stores appear more spacious and structured than before the refresh, increasing ease of shopping. Although the fruit & vegetable department was doubled in size, fresh ranges are limited. To offset the smaller choice in these categories, Netto stores feature local butcher shops and bakeries in front of the checkouts.

Considering the current developments, we predict a strong future development for Lidl and Biedronka with the latter’s compound annual growth around one half of Lidl’s, attributed to a slower expansion pace. At the same time, we expect Aldi, although dwarfed by the dominant players, to double its market presence by 2021, fuelled by consistently high like-for-like development and a steady expansion of its store network.

Learn more about LZ Retailytics: www.retailytics.com