By Perry Seelert, Strategic Partner & Co-founder, Emerge

It can be learned, it can be lost, but there is a process for imbedding it within your culture. Here are the ten drivers to becoming a best-in-class retail innovator.

When Prince Charles became King, it was a true birthright that was 73 years in the making. It was not a surprise, it was pre-ordained at birth, and even with his many personal blunders, tragedies and triumphs, you knew the crown was forthcoming. The monarchy is a birthright, where bloodlines and birth order mean everything, and the lineage is mapped and predictable.

Innovation doesn’t work that way, it is not a birthright. We can equally be surprised by product successes and failures, and even with all the consumer research you can muster, innovation is not predictable. New Coke had millions of dollars in research to justify its reason-to-be and look what happened.

Innovation, though, comes from a real process. In this piece, we are going to address ten important drivers behind retail innovation and those retailers who would generally be recognized as bestin- class. These drivers don’t all have to work in perfect harmony with one another, and some behaviors you may excel in and others not so much, but they are the underpinnings for success in innovation. You can measure them, you can gauge them in your organization, you can lose them, and you can acquire them over time. And as always, we can argue about them and debate their merits, but in my thirty years of experience, here are the ten that really matter.

1

Retail innovators have a clearly communicated goal and destination

Key Points

- Innovation is a known organizational imperative

- The goal is repeated (at all forums)

- Priority objective stated from the top

- All organizational levels get it

Retailers who excel at innovation put a clearly communicated goal forward to the organization (and externally to suppliers), and state this is a priority objective. These retailers see it as their destination, to be in a place that is in front of their competition and Retailers who excel at innovation put a clearly communicated goal forward to the organization (and externally to suppliers), and state this is a priority objective. These retailers see it as their destination, to be in a place that is in front of their competition and always a step ahead. It is a priority communicated from the top, known across all organizational strata and incentivized for further support. The goal is repeated frequently in the beginning for traction and becomes known over time.

Just look at how some of the large up-and-coming Retail Innovators like Albertsons and Kroger talk publicly about their achievements. Kroger literally reports how many new own brand products they launch every year (630 in 2021). Albertsons also talks about this openly in earnings calls, like earlier this year:

Vivek Sankaran

“In own brands, we introduced 837 new products and increased adoption in lower penetrated divisions, driving strong growth and improved margins…sales penetration reached 25.6% with the strongest performance in floral, deli and meat. During the year, own brands was awarded four Private Label Manufacturing Association awards and recognition… for innovation in private brand marketing.”

If you are to become a best-inclass Retail Innovator, you have metrics not just internally for your teams, but also for reporting them externally.

2

Best-In-Class Innovators have a culture that supports, nurtures and prioritizes product development.

Key Points

- Culture can be built. Costco didn’t start that way.

- Innovation is part of the stated mission

- Team members start to buy-in

- Tactical levers and rewards encourage it

- Your suppliers begin to understand it too.

Retailers who lead in innovation often didn’t start there, it took time and commitment (for example, Costco), and a realization that product differentiation was key. A retailer’s innovation culture is often transformed, in the beginning, by not just stating the goal (reference Innovation Driver #1), but also by a number of tactical levers being pulled. These levers become more cumulatively pervasive and strategically embraced in the organization with repetition. Cultural support means that team members outside an Innovation or Own Brands department subscribe to the mission. The benefit is often that the culture of innovation is not just inwardly facing, but becomes outwardly noticeable to the customers/suppliers too. It becomes part of your DNA.

Costco is a great example of developing a culture for own brands. Kirkland Signature launched in 1995, but wine only started in 2003 within the brand. Today, Costco sells $2.5B of wine globally and at least 20% is across the Kirkland Signature brand. Overall, Kirkland Signature is a $59B brand in 2021, and just 4 years ago it was $35B. This growth is phenomenal and it comes from a nurturing culture for own brands.

3

Innovators create and build the organizational assets to support their mission

Key Points

- Dedicated people (e.g., VP Innovation, Product Developers)

- Empowerment and crossfunctional alignment

- Reporting to the top

- Often integrated with own brands team

Innovation requires a top-down commitment and cultural repetition, and also dedicated people assets that go beyond the procurement team. These assets may consist of VP Innovation, Product Developers, Culinary Specialists/Chefs and R&D, and they often work hand-in-hand/ integrated with the Own Brand arm of the organization. They frequently report to the Chief Merchant or CEO to demonstrate that they are a focus and they are empowered to work with and even seek out new suppliers.

4

Experimentation is rewarded, even expected at Best-In-Class Innovators

Key Points

- Failure is never envied, but embraced

- Rewards at all levels for innovation, especially within category management

- Innovation guided by insight, not snuffed out by syndicated data and “proof of concept”

Experimentation at leading retail innovators is encouraged, and there is often a clear reward system that in place across departments for making it happen. While “failure” is never envied at these Best-In- Class retailers, they embrace a dose of failure as part of this push for experimentation. Most mainstream retailers have disincentives for innovation through their Category Managers – seeking out slotting, circular placement fees, typical advertising buckets and other below-the-line CPG contributions for big data, category captainship and the like. Systems are often not built for innovation. It is also the idea that “finding, settling upon and choosing the white space” takes time, goes against CPG data analysis, and is simply unproven territory/risky that leads to a cautious environment. At places where innovation thrives, the reward systems have been gently upturned so that new product development is seen as part of the culture and an organizational imperative.

Trader Joe’s, a Best-In-Class Retail Innovator, has dozens of experiments-gone-wrong or “failures”, some of which are legendary across their loyal shoppers. But, they wouldn’t have it any other way, because you can’t live on the bleeding edge of pursuing new ingredient combinations and product ideas without some failure. If you don’t have failures you aren’t trying hard enough.

5

Innovators target big categories, not just niche

Key Points

- Retailers are not all alike in their innovation philosophies

- But there is one thing they have in common

- They all include big categories within their innovation targets

- Also, all products they develop align with the retailer’s DNA

It is important for retail innovators to develop an upfront philosophy about where they seek out innovation.

- At Costco, the philosophy is to create differentiation around the most consumable, everyday, high-touch categories (red solo cup, 1⁄4 lb. hot dog, chicken soup, rotisserie chicken).

- At Trader Joe’s and Loblaw the philosophy is to add a unique “twist” to the ordinary.

- At Wegman’s it is to provide culinary inspiration with creative ingredient/menu/meal integration (tomato oil, inventing basting oil, etc.)

- At Kroger it is to target key tiers/ areas for future growth (natural/ organic and Simple Truth, Private Selection and premium).

Within a chosen philosophy, these retailers pick big categories to target, transform and ultimately “own” them in the consumer’s mind. While the niche areas are not ignored, it is the fertile larger categories/departments that become the focus areas. All targeted areas also need to fit within the retailer’s DNA, their perception and who they are at their core.

A perfect example of targeting a big category is what Loblaw did 34 years ago with The Decadent cookie, which supplanted Chips Ahoy as the #1 chocolate chip cookie and then got extended to virtually every department over time.

6

Marketing and merchandising are highly integrated in launching new products at Innovators

Key Points

- The process doesn’t stop with a new product

- Innovators utilize all retail media to support

- Each product has a story and an angle

- Told through social and digital media

- Merchandised off-shelf too

While the product development is a key part of Retailer Innovation, it does not stop there, as it materializes and is brought to life in the store and through retail media. There is a core story that is written for the product, a consumer “angle” if you will, and this story is told consistently – at shelf, on display, through integrated merchandising, on line, through social media, through magazines, etc. If you think about the four stage process for innovation success (1/ shaping the idea, 2/finding the source, 3/formulation and logistics, 4/marketing-merchandising execution), it is this fourth stage that is critically important in getting consumer traction. Retailers like Loblaw, Trader Joe’s and Wegmans put a strong emphasis on all of the integrated communication.

When Loblaw launched The Black Label Collection, an elevated tier within President’s Choice, they utilized various media and merchandising, and it all cohesively worked together to tell the story of the brand.

7

Retail Innovators have a proactive versus reactive mentality

Key Points

- Innovative retailers direct the product development process

- It isn’t solely derived from the supplier

- Research is encouraged, but is additive and not a blockade

- Goal is first-to-market

Innovation-led retailers have a mentality that they will direct the ideation and product development process rather than be the recipient of it (great if suppliers supplement, but not as the sole source). Being proactive in your product innovation is tougher in many regards, as there will be an unproven consumer, often requires some research, and it also involves engaging a supplier who is willing to co-invest in a new idea. However, it is the proactive mentality that is key to being firstto- market and owning the idea in the shopper’s mind.

8

Key Points

- Innovators often involve the consumer upfront in the process, and their involvement is contagious

- Shopper (and chef) are an upfront part of the process

- Insights are captured, but intuition is too

Top tier frequent shoppers and “best customers” have a vote and are socially engaged

The evidence is honestly split amongst retail innovators regarding how much they involve the consumer upfront in the ideation. Wegmans often first involves their chefs, who have direct interface with consumers, often spurring ideas. Trader Joe’s is less intent on getting a vast amount of consumer input upfront in their product development, whereas Kroger and Safeway are seeking out consumer insights through focus groups. Kroger has also sought out their “best customer” (as identified through shopper card data) in socializing, blogging and getting input about new products. This type of top-tier customer involvement has been highly effective, even contagious, in building awareness.

9

Best-In-Class Retail Innovators are making serious investments in culinary centers, chefs and kitchen assets to experiment

Key Points

- Culinary centers are becoming the norm (Walmart, Kroger, Safeway)

- Chef-staffed

- New formulations, sensory testing, “live” consumer panels

- Restaurants are “living labs” (Wegmans)

Right in line with organizational/ people asset investment, there are also modest (and sometimes not so modest) investments retailers are making in Culinary Centers. These culinary investments become the epicenter of where new formulation, sensory testing, “live” consumer panels, R&D, training and chef experimentation happen, as is the case with the Walmart Culinary Center (12,000 sq ft with test kitchens).

Safeway and Kroger also have invested in chef-staffed culinary centers. Another aspect of culinary learning happens in retailer-owned and managed restaurants, where the investment also has the benefit of being a living laboratory for ideas.

Wegman’s restaurants (like Amore) is often used to test new products, new experiments and provides immediate consumer feedback that is essential.

10

Innovators have adept understanding of trends

Key Points

- Shopper (and chef) are an upfront part of the process

- Insights are captured, but intuition is too

- Top tier frequent shoppers and “best customers” have a vote and are socially engaged

Retailers who are leading in innovation also focus on “trend understanding” as a key, foundational part of the process. This is a studied and regimented process that involves not just secondary insights (articles, reports, syndicated info), but also primary insights into fashion, lifestyle, health influencers within consumers’ lives. Retailers who examine trends also adapt and apply them across their consumer segmentation model (a varied look at the different consumers across the retailer, describing their personality, economic strata and psychographics). Leading retailers do not want to apply all trends to their business and innovation philosophy, they are selective about which trends to exploit, using those that make sense for their retail DNA.

The Bottom Line

Innovation and being first are imperatives in today’s retail world. Innovation can be learned, it can be acquired with the right cultural adoption, and it can also be lost if it becomes devalued. Innovation is not a birthright.

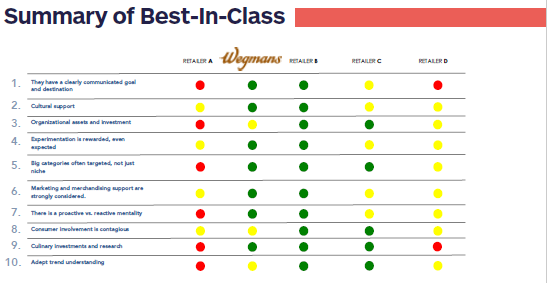

To keep yourself honest and always aspirational, you can also compare yourself to the best. Take each of the ten Innovation Behaviors and utilize a stoplight analysis to compare and contrast your progress and where you want to go. But just remember, in the immortal words of Ricky Bobby’s father from Talladega Nights “if you ain’t first, you’re last”. It is true with own brands innovation also, if you ain’t first, you’re last.