Promises Added Growth

Executive Summary

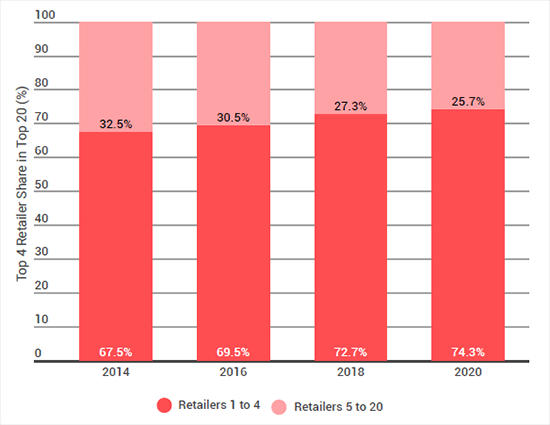

Retailers in Russia will need to look for new growth channels, as evidence shows that the rise of small format discounting minimarkets is beginning to slow. Challenges include revenue cannibalisation and rising costs due to logistical adversities in new territories. As a result, we will see formats with higher space productivity increase in importance, such as liquor stores, drugstores and supermarkets. As they diversify into new growth channels, the top four retail players in Russia are set to expand their share of revenue among the Top 20 players from 67.5% in 2014 to more than 74.3% in 2020.

Each of them is staking their claim in different market segments: X5 Retail Group, the market leader, is expected to show stronger growth in the supermarket channel; Magnit is expanding into the drugstore and pharmacy sector, away from headon competition with its arch rival; the newly formed liquor monopoly of Dixy, Krasnoe & Beloe and Bristol will rise to third position and Lenta will dominate large-format operations.

Diversifying to Grow

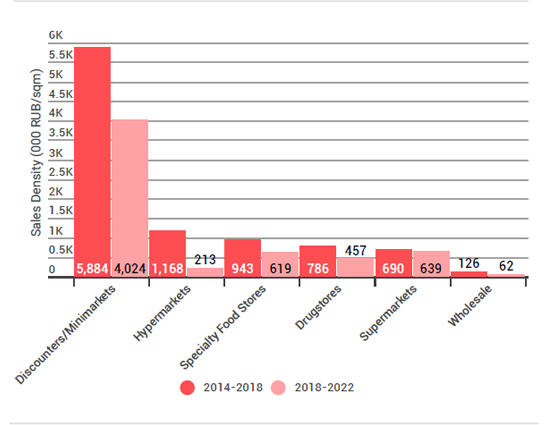

Although small food formats are expected to see most of sales area increase over the next few years, dynamics are slowing down in favour of liquor stores and supermarkets.

Analyst View

The motor of Russia’s high-speed retail growth, proximity discount concepts, is stalling. The Top 20 players have reached almost 35,000 small-size stores across the country, translating to a store opening rate of almost 5,000 per year over the past four years. Now catchment area cannibalisation is putting like-for-like development in more developed areas at risk and logistical challenges in remote territories are putting pressure on profitability. Consequently, retailers are now turning to a more cautious, selective expansion approach for the future. Leading banners Pyaterochka and Magnit Universam are poised to retain their top positions for the foreseeable future, but other formats will slowly increase their footprint in the shadow of the industry duopoly. According to LZ Retailytics forecasts, it is liquor stores, drugstores and supermarkets that will steadily expand their footprint, constituting the new growth and profit drivers.

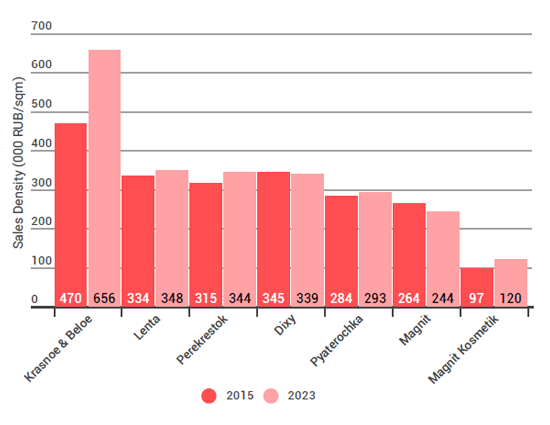

New Formats Drive Value

Against all expectations, the seemingly unstoppable proximity discounters might not be the universal remedy in Russia’s current retail framework. Magnit Universam, shaken by plummeting buying power in the Russian regions, is losing like-for-like revenue for the second year in in a row. Also Pyaterochka’s like-for-like growth rates have been decreasing, reaching a value below food inflation for the first time since the onset of the economic crisis five years ago. Earning money with the price-focused Magnit and Pyaterochka banners will be increasingly difficult in future; and it is the comparatively low sales densities of these two discount banners that have persuaded the market leaders to look for other sources of income. Consequently, Magnit is pushing expansion of its Magnit Kosmetik drugstores, which were just recently hailed as the leading national network in the channel. At the same time X5’s supermarket banner Perekrestok has been attracting significanlty more customers on same sales areas than all other market participants – thanks to the rollout of its new regional model.

Dixy Group, the seemingly defeated third player in the minimarket segment, is preparing its comeback in an alliance with liquor store operators Krasnoe & Beloe and Bristol, whose store base of more than 10,000 shops across the country promises a formidable counterweight to the

Top grocers in Russia will increase their lead among the largest retailers in the country.

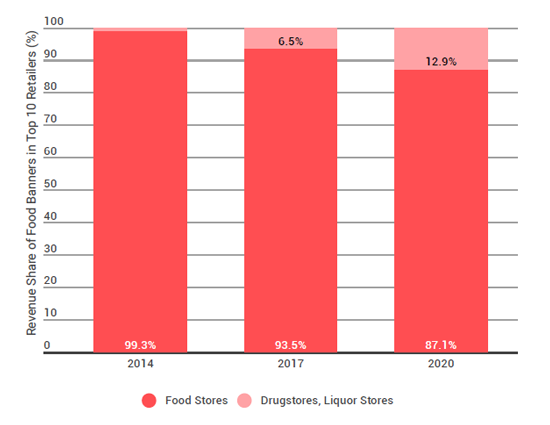

With profitability in traditional food channels sinking, leading Russian retailers will further diversify into specialised formats.

Mergers & Acquisitions Step Up

With X5, Magnit and Lenta extending their lead – partly through minor acquisitions of ailing regional chains such as as Sedmoi Kontinent and Holidey – we are convinced there will be other major moves in the mergers & acquisitions field in the near future. The fusion of Dixy, Krasnoe & Beloe and Bristol (Albion- 2002) is only the first step. Dixy Group has put its Victoria supermarket division up for sale, with Lenta and X5 potential buyers. Okey Group has declared it will focus on developing its DA! discount network to national importance, possibly opening up an opportunity to sell its big box business – state-of-the-art, but nevertheless too small-scale to compete with channel leader Lenta, who is more than three times its size. Also, Auchan’s ‘Renaissance’ project foresees the closure of one-third of the store network in the medium term, making a sale of part of its hypermarket base highly probable. Effectively it is only the top four players, X5 Retail Group, Magnit, Lenta and the new Dixy conglomerate, that have a chance of extending their maket share in Russia. The follower pack of Auchan, Metro AG and Okey Group all are in the process of reviewing operations or diverging into new formats to avoid head-on competition. As a consequence, we expect the market share of these Top 4 among the Top 20 players to steadily increase from 67.5% in 2014 to a forecasted 74.3% in 2020.

Tapping Into New Segments

With consolidation stepping up and profitability sinking, we can expect to see more retailers diversifying into near-food market segments. Liquor stores, drugstores and pharmacies as well as urban convenience stores are all formats that promise additional growth opportunities due to fragmented markets, while at the same time providing higher profitability on ultra-small sales areas.

Although small food formats are expected to see most of sales area increase over the next few years , dynamics are slowing down in favor of liquor store and supermarkets.

Russia: Sales Area Gain by Sales Channel, 2014-2018-2022, (000 sqm)

Discounting proximity formats, the most important retail channel, take only second place when it comes to sales density and productivity growth

Russia: Selected Banners, Sales Density, 2015-2023 (000 RUB/sqm)

About LZ Retailytics

LZ Retailytics is an international retail analyst group supporting the grocery retail and consumer goods industries with insightful information, data and analysis to facilitate business planning and decision making.

The group delivers these insights in the form of an innovative, fully mobile-enabled digital product as well as through workshops, inhouse trainings and advisory projects. LZ Retailytics is part of Lebensmittel Zeitung (LZ) the leading trade and business newspaper for grocery and consumer goods in Germany.

LZ Retailytics’s team of senior analysts is spread internationally and all are well known for their deep knowledge of the retail industry and their specialisation in new store formats, e-commerce and digitalisation, private label, hard discounter, retail technology and logistics.

Learn more about LZ Retailytics: www.retailytics.com