by Perry Seelert, Strategic Partner & Co-founder of Emerge

Plant-based foods have finessed their way into the mainstream, but are at a critical inflection point as they aim to be loved by more consumers

Let’s get something straight from the start. Plant-based foods are not a fad, they are not a fleeting trend, they are not the latest craze, and they are not a Grapefruit Diet dressed in sheep’s clothing. No, plant-based eating is here to stay, and it will grow, even with inflation headwinds that have affected progress in some sectors like plant-based meat last year. Younger consumer generations will be the fulcrum for driving the entire plantbased industry.

The culture of plant-based eating, though, is at an important inflection point, and it prompts certain strategic questions for manufacturers and retailers alike:

- How can marketing and branding acumen continue to attract consumers, particularly those who self-identify as flexitarians?

- What is the retailer’s role in driving growth, especially with respect to their own brands?

- Are there portfolio and ingredient boundaries that CPGs should consider reining in or expanding (jackfruit- everything, potato milk or vegan shrimp)? How do they affect consumer perception and who are they really targeting?

- How and why should I link plantbased within my food service strategy?

The Facts Are Compelling

Today, there are 1.5 billion people globally who follow a vegetarian diet, about 1 in every 5 people. Certain cultures are innately plantbased, for instance, in India where almost 40% of the country is vegetarian (about 400 million consumers), compared to the U.S. where just 5% of people say they are totally plant-based (though 32% identify themselves as “mostly vegetarian” or are actively reducing their meat consumption).

But cultural differences aside, most consumers around the world are expressing increasing interest in plant-based foods than ever before, and it is spurred by the following beliefs:

They are healthier…The science is definitely supportive of this consumer belief, as plant-based diets reduce the risk of heart disease (by 40%), the incidence of cancer (by 10-12%), and type 2 diabetes (by 50%). Though it is more just the general consumer knowledge that a plant-based lifestyle may be healthier because you are eating fewer calories, less fat and less cholesterol.

They are more environmentally conscious and sustainable… This is one of the more salient beliefs driving the plant-based movement as 48% of consumers opt for a plant-based diet for environmental reasons, up from 31% in 2018 (source: Food Navigator). There is lots of literature to suggest that a global shift to a vegetarian diet could cut greenhouse gas emissions by 63% (Time magazine), and that livestock alone accounts for 14% of GHG. Science also points to animal agriculture contributing to rainforest destruction, which is similarly a driver for environmentally conscious consumers getting motivated to eat plantbased diets.

They are not sacrificial from a culinary point-of-view… There used to be the thinking that pursuing a plant-based diet was a culinary sacrifice, a creative sacrifice, and that you were forever condemned to eating steamed broccoli and carrots for the rest of your life. People did not know how to cook vegetables as a true entrée and main plate dish. This is changing dramatically, and it is motivated by incredible access to plant-based ideas via TikTok, books like Ottolenghi’s “Flavor” that transcend old vegetarian bibles like the “Moosewood Cookbook” of the 1970s, and celebrity chefs like Gordan Ramsey teaching us how to make cauliflower steak. To add to all of this, today there are 50 vegetarian and 20 vegan restaurants that have earned a Michelin star. There is no longer any culinary sacrifice, real or perceived, in pursuing a plantbased diet.

They don’t ostracize me… 20 years ago, if someone showed up to your Holiday dinner and said, “excuse me, but I can’t eat the Thanksgiving turkey or Christmas roast”, they would get a cross-eyed look from the host and quietly be ostracized. There was a tacit stigma in being a plant-based consumer. But that has all changed, and it is simply a matter of numbers, because more than 4 in 10 consumers today are actively trying to reduce their consumption of animal-based meat products. Millennials drive this statistic, with 54% reporting that they are trying to be more plant-based. Yes, even during the holidays.

They are more ethical…For people who believe plant-based diets are more ethical, this usually stems from veganism, which rejects all animal products including eggs and dairy (and even honey), and extends to cosmetics, soaps, etc. that are produced with animal testing. The core vegan is the most strident consumer group within the plant-based umbrella, believing that poultry and beef producers raise and slaughter their animals in inhumane conditions, that it is cruel, and thus they oppose the “exploitation” of non-human animals overall.

The ethics of meat-eating versus true veganism admittedly gets very murky, but it is a driver for many who pursue plant-based eating. Vegans represent the smallest, but I would say the most passionate of the plant-based eating universe, and in the U.S. about 1 in 4 vegetarians is truly vegan. The UK has the most vegans in the world, and Israel has the highest percentage (5% of their total population).

Growth In The Future

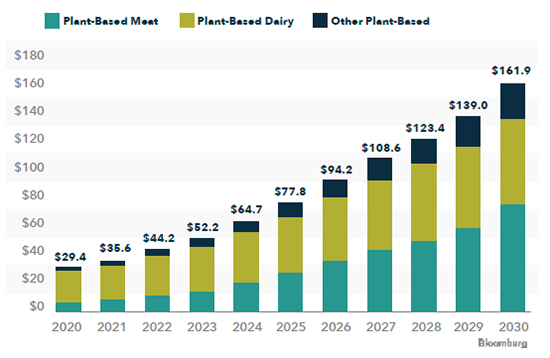

Almost all experts predict sustained global growth in the plantbased industry, with a long-range forecast that the market size could be as much as $162 billion (Source: Bloomberg).

Today, the plant-based dairy sector is by far the largest, and you can see how the expected trend shows plant-based meat catching up proportionately during this decade. I would say “maybe” and say it with some caution. It depends a lot on food service and restaurant menu integration, which we will talk about later. Critics will point to 2022 as a plateau year for plantbased meat and cheese, with frozen and refrigerated meat alternatives combined $ sales -3.8% and unit volumes -11% November 2022 vs. November 2021 in the United States (Source: IRI). A lot of this challenge had to do with inflation and sheer price – the average cost per pound of plant-based meat is about twice that of animal-based meat (Source: GFI).

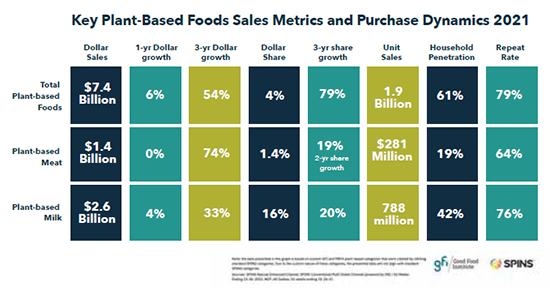

In the United States overall the plant-based market is over $7.4 billion, with the milk sector alone being about double the size of the meat sector.

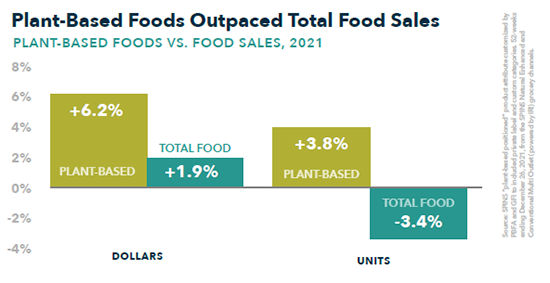

Clearly there is tremendous potential for the plant-based food industry, and the sales year-on-year are outpacing total food sales, growing 6.2% overall and three year dollar share growth over 79%.

How does the industry ensure that this growth and the expectations for the future continue to become true? How do you attract more consumers, who do you target, and how do you get them to actually consume more?

The answer is in getting people to experiment more, continue to penetrate families and households who are already inclined, and importantly, target the flexitarian and attract future flexitarians into the mix.

The Importance of the Flexitarian

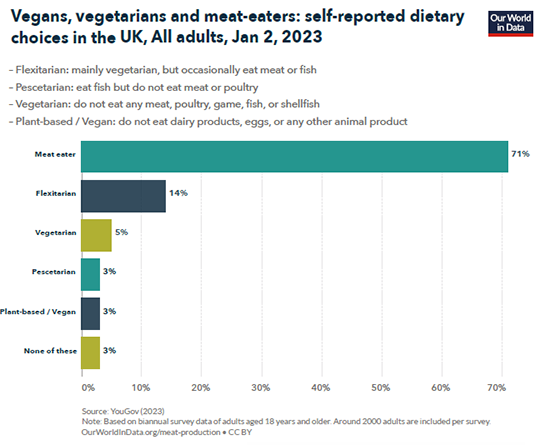

If vegans are the most ardent and strict within the plant-based consumer universe (because there are often moral, ethical, and religious motivations), then as their name implies, flexitarians have the most flexibility in approaching vegetable- forward diets. Simply defined you can see each group as follows:

- Meat-eaters: who as we have said, are also buying plant-based foods

- Flexitarians: primarily plantbased diets, but don’t set strict boundaries. They eat animal products sparingly

- Vegetarians: they do not eat meat, poultry, game, fish or shellfish, and many do eat eggs and dairy (“lacto-vegetarians”)

- Vegans: as we have said earlier, no animal products or byproducts at all

The data can be a little fuzzy on this, but in the U.S. according to a recent study (Source: Sprouts and One Poll), 47% of Americans describe themselves as flexitarians and more than half (54%) ages 24- 39 identify themselves as such.

In the U.K. according to YouGov (2023) a study of all adults showed that 14% of the British population self-identified as flexitarian when it came to their dietary lifestyle.

Most consumer marketing companies would look at the plant-based universe through a segmentation lens, and they quickly see that the vegan and vegetarian are already a part of it. They are in the boat. It is the rise of flexitarianism that represents the real potential, and it correlates with younger generations of consumers. And, importantly, it correlates with the language CPG companies are using to bring more flexitarians into their legions of brands.

It is Impossible.

It is Daring.

It is Innocent.

It is Bol.

It is This (Isn’t).

Enthusiastic language that signals it is loaded with flavor, that it is on the cutting edge, it is creative and colorful. It is all about getting the flexitarian to buy-in.

How Retailers Are Driving Plant-Based

Retailers see the opportunity, they see the growth, and there some fundamental tactics they are employing to engage the plant-based consumer.

KEY RETAILER TACTICS:

- Make it prominent in-store

- Embed your own brand plantbased portfolio demonstrably

- Promote it intentionally and creatively

- Incorporate into your digital strategy

Retailers like Kroger and Waitrose are creating plant-based and even vegan sections within their fresh departments, carving out space that is noticeable and flagged.

TACTIC #1:

Make it prominent in-store

TACTIC #2:

Embed your own brand plant-based portfolio demonstrably

With tactic #1 in place, then the next thing retailers are doing is making own brands a key focus within the set itself and doing this in the most important categories (like plant-based milk).

TACTIC #3:

Promote it intentionally and creatively

Just like any brand, but especially when there is a consumer target (the flexitarian) that you may be trying to attract, you must be creative in the way you engage them. Plantbased eating for the uninitiated can be perceived to be boring and lifeless, so supplying consumers with ideas is essential.

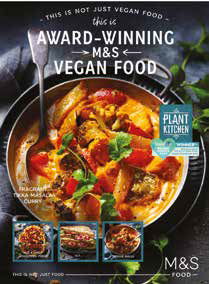

Chefs got into the game of Vegan- January (World Vegan Month) or Veganuary, but retailers like Marks & Spencer did too, and used it as an opportunity for further excitement around plant-based eating.

TACTIC #4:

Incorporate Into Your Digital Strategy

With plant-based consumers leaning slightly younger, it is especially important to ensure that retailers incorporate them into their digital strategies. They not only need to be readily accessible, but also easy to find and shop based upon your plant-based needs. Ahold’s Giant and Stop & Shop divisions are making their web really intuitive to navigate for any meat-free shopping needs, they are publishing plant-based recipes through their “Nutrition Partners and Our Picks” program, and conduct plant-based on-line webinars to educate newer consumers.

How CPG Manufacturers And Brands Are Driving Plant-Based

As retailers fight for mind share around plant-based foods and this shopper of the future, manufacturers are doing the same thing, trying to gain brand loyalty and traction. It is an all-out-fight between brands, but there are some common themes.

Design And Branding Are Critical Levers

If you look at the “brandscape”, you can see plant-based brands that are unafraid to show a little bravado, a little in-your-face appetite appeal and sensibility. The language is colorful and it is driven to conquer their perceived consumer challenge (which is around taste).

Brands like Oumph!, This [Isn’t], V Bites and Tattooed Chef have been designed with a youthful energy bringing out the creativity and appetite appeal of the dishes. The dishes also are innately creative. These brands are showing off their personality, they sit loudly in the case, and they have power.

Their Advertising Has Equal Panache

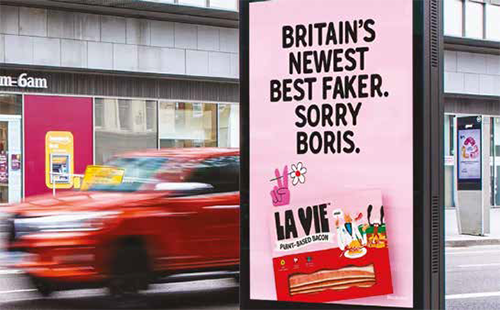

Many of the plant-based brands, though nascent in their development, are investing in equally powerful advertising to get noticed, as you can see with Impossible and La Vie in France.

Impossible just recently launched their first national campaign as they gear up for their continued fight for the future with Beyond. Also, La Vie might have a much smaller media budget, but they get your attention right at a bus stop with their biting sense of humor.

Skillful Foodservice Integration

Maybe the most influential marketing strategy by plant-based brands has been their integration into food service and restaurants, and remember the target they are coveting, the flexitarian. This strategy has mutual benefit for both the restaurant chain and the brand, and I believe it is just the tip of the iceberg of what we will see in the future.

Impossible at Nathan’s, Morningstar sausage at Dunkin Donuts, Beyond Meat at TGI Fridays, Pizza Hut and McDonald’s. These are all high profile collaborations, and there are many others, addressing every day part meal occasion.

Brand Blurring & Brand Loyalty

While the plant-based brands are doing some skillful integrations into food service along with thoughtful packaging design and savvy advertising, there is still a blur that exists.

Brand blurring and brand confusion for your plant-based newbies, who cannot determine how one brand might be better than another. Many flexitarians who are relatively new to plant-based foods find it tough to discern, and this leads to little loyalty at this point.

One battle that is basically a glovesoff brawl right now is between Impossible and Beyond. Last year, at least from a sales standpoint, Impossible would say they have won, but the battle for consumer loyalty is far from over.

When consumers cast their eyes into the refrigerated or freezer cases and wells, what do they see, and how are they drawn to a brand? It looks 50-50 to many shoppers staring at the case.

Beyond (the idea of going beyond what you would ever fathom) and Impossible (the idea that it is impossible for plants to taste so good), are conceptually the same.

Today, I think many consumers think their essence is basically indistinguishable. The legions of Impossible fans and Beyond fans are not that passionate in my opinion. And all of this points to a huge, massive opportunity for retailers and their own brands, because CPG brand equities are still slowly forming.

The Own Brand Opportunity

Retailers have been fairly aggressive in developing their plant-based own brands, whether they are literally new or whether they are extensions of something more familiar (for example, Kroger’s is an extension of Simple Truth).

One of the clear standouts in the U.K. has been what Marks & Spencer has created in Plant Kitchen (launched 2019), a deep portfolio that covers a wide array of non-dairy and plant-based frozen and fresh foods.

Beyond stellar design, they have created television advertising that is smart (focusing on great taste), out-of-store media, a dedicated web portal, a magazine and incredible food photography at every turn.

Marks & Spencer

Conad:

Conad also has a strong entry into plant-based food with their Verso Natura Veg line, launched in 2016 and part of a larger Bio and Eco umbrella. What is impressive is how they have targeted critical core categories like non-dairy milks, grains, and symbolic soulful Italian specialties like gelato.

Kroger:

Kroger has built one of the largest and most successful own brands in the world with Simple Truth, and the plant-based segment branched from the larger umbrella launched in late 2019. It has been amazing to see how they are attacking dairy free frozen novelties and frozen desserts and doing it with such taste appeal.

The Challenges Ahead

The growth and potential for the plant-based industry is tremendous, and own brands are positioned to be a real contender in this battle for flexitarian consumers and mind share. Creative cuisine and showcasing it vividly is one of the fundamental drivers for success.

But the challenges are real.

One of the challenges that many experts point to is giving consumers confidence that plant-based cuisine is not overprocessed. According to Better Homes & Gardens (Jan 20, 2023),

“Though the base of plant-based meats is a plant (usually soybeans, peas, and/or wheat), these ingredients have been highly processed. In most cases the main ingredients are stripped down to high-protein, low-fiber, colorless powders mixed with preservatives, oils, natural or artificial coloring, gums, and seasonings.”

While the processing may in some cases be a function of trying to produce great taste, it is defeating the idea of healthier plant-based foods.

Another challenge is the “vessel” itself for the meal. Consumers have accepted cauliflower as a creative vessel, but will they accept something like jackfruit, which many experts say has a neutral taste with an ability to morph into a variety of main plate meals. I’m not so sure quite honestly, only because jackfruit and what it is and where it comes from (not to mention what it looks like) requires a lot of explanation. But time will tell……

Marketing must-have’s like an accessible price versus animal-based products, and appealing taste and texture (though I would say there are some companies that are still producing rubberized nuggets), all seem to me to be functional and basic costs of entry. If there is one virtue of marketing that is constant, it is that consumers will never sacrifice great taste.

I’m excited about the future, and what could lead to a $162 billion global plant-based industry by 2030. Retailers are poised to win a large chunk of this business through their own brands, and strategic and creative thinking will be the path for driving it successfully.

Perry Seelert

Perry Seelert is retail branding and marketing expert, with a passion for challenging conventional strategy and truths. He is the Strategic Partner and Co-founder of Emerge, a strategic marketing consultancy dedicated to helping Retailers, Manufacturers and Services grow exponentially and differentiate with purpose. Please contact Perry at [email protected]