By / Christina Veiders

A delegation of Peruvian food producers-exporters returns to the 2014 PLMA Trade Show in Chicago in November to compete among bigger global players and their South American neighbors for a stake in the $112 billion private label market in the United States.

Peru’s producers are concentrating on their diverse, often unique, offerings while emphasizing quality, service and competitive pricing.

Some like Danper and Ecosac, vertically integrated agro industrial companies from Peru, as well as Gloria S.A. and Inka Crops, leading dairy and specialty snacks manufacturers, have developed well-established relationships in private label worldwide.

Others such as Wiraccocha del Peru, Gelafrut SRL, MG Natura and Panaderia San Jorge S.A. are just starting to develop business in the U.S. and will be exibiting at PLMA for the first time

Global Retail Brands traveled to Lima, Peru in August to attend the sixth edition of Expoalimentaria, South America’s largest international food and beverage trade show, produced by the Association of Exporters of Peru (ADEX).

Visits were made to several of Peru’s leading agro producers-exporters along the fruits and vegetable route in northwestern Peru to see first hand how Peruvian growers have turned arid desert land into fertile fields for growing a variety of produce, including blueberries.

Of the US$2 billion in agricultural produce Peru exported the first six months of this year, 28 percent or US$561.4 million came from the northwestern regions of Piura and La Libertad where producers such as Ecoacuicola, Dominus, Agro Mar Industrial, Camposol and Danper export most of their fresh, processed and frozen products some of which is destined for private label.

Some Peru-based suppliers, who will be attending this year’s PLMA Show, were asked about their plans and expectations for export and developing their U.S. private label business.

Gloria S.A. makes its fourth trip to PLMA to sell its evaporated milk, particularly sweet condensed milk in cans, said Miguel Arteaga, regional manager America.

Its evaporated milk can be found as store brands at California retailers Superior Grocers and Vallarta Supermarkets. The company has also worked with Goya Foods, Lady Liberty Brands (a division of McLane Global) and distributor Iberia Foods, said Arteaga.

Over a decade ago, Gloria began expanding into international markets and now exports its evaporated milk and other products to 80 countries. Gloria’s export sales of evaporated milk in 2013 were US$FOB 96.8 million, reports ADEX.

The company says its quality assurance and high standards to strict production controls and its ability to adapt to customer requirements, such as providing special local products and providing advisory services in logistics and marketing, give it a competitive edge.

DanPer’s Jorge Aranguri >>

DanPer’s Jorge Aranguri >>

Danper Trujillo S.A.C. will be attending its fifth PLMA show and will also be celebrating its 20th year in business. The grower-exporter, which employs 6,000 people, points to its sustainable business philosophy that embraces social, economic and environmental responsibility as a distinction of its go-to-market strategy.

While its main crop is asparagus, the grower also sells a variety of peppers, artichokes, avocados, mangos, grapes, blueberries and super grains. It operates 7 processing facilities for cans, jars, frozen and fresh produce.

According to Danper Director Jorge Aranguri, the emphasis at PLMA will be on quinoa and different tapenadas and pestos developed on Mediterranean taste profiles and made from artichokes, peppers and asparagus.

“Innovation for us is very important because like in any business the only constant is change. Consumers are always looking for something different. We want to be ahead of the curve,” said Aranguri.

Danper is supplying their products to Kroger, Whole Foods, Trader Joes, Walmart, and Costco, Aranguri noted.

Ecosac’s Gerd Burmester >>

Ecosac’s Gerd Burmester >>

Ecosac, formerly Ecoacuicola, has become Peru’s second largest producer of fresh water shrimp and the third in canned piquillo peppers.

Commercial Director Gerd Burmester’s goal is for wider distribution into the U.S. of a diversified portfolio of products that also includes bell peppers, banana peppers, paprika, table grapes, avocado and mango.

“We want be in the market with more products. We now have about 30 percent of canned products in retail sites. In one year, we want to be in 60 percent in retail. Double the share of our products in retail.”

To help achieve that goal, Burmester said, Ecosac has developed its own brands that it trials at supermarkets before private label deals.

“Sometimes supermarkets do not want to give space on the shelf so they ask us to go in first with our brand. We have a nice looking label.”

Inka Crops’ Ignacio Garaycochea >>

Inka Crops’ Ignacio Garaycochea >>

Inka Corps returns to the PLMA show for the third time with its snack chips made from plantains, cassava, sweet potato, and Andean corns and beans.

About 65 percent of its total sales is private label and 90 percent is exported to the U.S., said Ignacio Garaycochea, sales-marketing.

Inka stands out for unique items such as giant corn, said Garaycochea.

“We are flexible and versatile. Everyone can make good things and good snacks but not everyone can deliver good service. Good product and service is what we have achieved at an affordable price.”

The company points to its R&D department that works with clients on different flavor and nutritional profiles, its just-in-time delivery and its ability to meet various volume requirements.

Among chains said to be selling Inka products as a store brand are: Sprouts Farmers Market, Goya Foods, Trader Joes, Big Lots, 99 cents, Walgreens, Bristol Farms and Gelsons.

“We have two strategies to tackle dollar stores and high-end chains like Harris Teeter and Publix,” said Garaycochea.

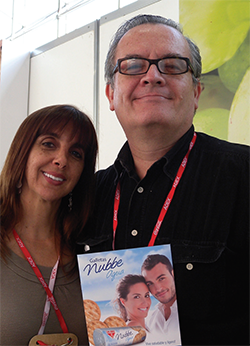

Panaderia San Jorge’s Beatriz Farah and Francisco Leo >>

Panaderia San Jorge’s Beatriz Farah and Francisco Leo >>

Panaderia San Jorge S.A. is a 70-year old, family owned company that will be a first-time exhibitor at PLMA, featuring its pasta, cookies, crackers, and its Peruvian version of the panettone cake.

The company recently invested in revamping its pasta making facility. “I think our pasta has super good quality and we can sell it at a very good price,” said Francisco Leo, marketing chief.

The company said it is selling some of its products under the San Jorge label as a test at Walmart in Florida.

Wiraccocha del Peru’s Glicerio Felices >>

Wiraccocha del Peru’s Glicerio Felices >>

Wiraccocha del Peru works in conjunction with 800 Andean farmers in the Ayachucho region to produce 1,400 tons of organic quinoa of which half is exported to the U.S.

General Manager Glicerio Felices said in developing sustainable farming Wiraccocha is helping underprivileged Andean farmers get fair prices for their grains and improve their standard of living. Wiraccocha will be a first time exhibitor at PLMA.

South America’s Largest Food Trade Show

Within the last decade Peruvian growers-producers have proved their legitimacy in delivering a wealth of diverse foods and beverages — many with an innovative twist — to world markets.

That was evidenced during a special media tour of growers-producers in the Piura and La Libertad regions in northwestern Peru. The tour was sponsored by the Association of Exporters of Peru (ADEX), which highlights different growing regions of Peru during its annual trade show, Expoalimentaria. Together the two regions represented 28% of Peruvian agricultural exports from January-June of this year. Peru’s development of its agribusinesses is aided by a stable economy, free trade agreements, a variety of fertile microclimates and a strategic location for trade.

From 2009, when the Association of Exporters of Peru (ADEX) first launched Expoalimentaria, an event that showcases Peru’s rich offerings in food and beverages, exports increased 73% from $2.4 billion to $4.1 billion in 2013.

During that period, Expoalimentaria became a leading trade show for South American exports. It grew from 205 exhibitors in 6,600 square meters of exhibit space in 2009 to 665 exhibitors in 23,400 square meters in 2014. Total visitors soared from 7,850 to over 38,000 visitors this year. During the sixth edition of the show, August 27-29, Peruvian producers and international buyers generated US$730 million in business, according to ADEX President Gaston Pacheco.

When asked to cite what made the 2014 show different from previous ones, he said the “sophistication in the way smaller producers were presenting their final products.”

Many large commercial producers have invested with smaller farmers to produce sustainable farming.

Pacheco noted food quality and safety assurances, advances in agri technology combined with ancient growing methods, and the fulfillment to trade commitments as contributing to Peru’s growth in exports.

A challenge is the infrastructure from roads to ports that Pacheco said the government was working on to be more competitive in export.