by Perry Seeel Seelert,Strategic Partner and Co-Founder Emerge

The Cumulative Effect of all Channels and Retailers on own Brand Perception

A consumer’s psyche is a weird thing.

With brands it is important to point out that the fall is usually quicker than the rise. Look to the Tylenol scare of 1982 or more recently, the E-Coli outbreaks at Chipotle restaurants, and you will see brands that descended sharply, with lots of perceptual damage that lingered. The fall is sudden, trust is ruptured, and it takes time and tangible changed brand behaviors to earn it all back.

The rise of a brand, from “lowly” to “revered” is not quick at all, it is much more deliberate, and for many, impossible. Hyundai was introduced from Korea to the U.S. in 1986 (the subcompact, low budget Excel model), and after deliberate product improvement, quality manufacturing investment, extended warranties and persistent marketing they have created a Korean luxury car segment where their Genesis G90 now sells for $75,000+. From sub-compact economy cars to competing with Lexus and Audi, you bet, though it took over 30 years.

The Pathway To Trust For Private Brands

Like Hyundai, it has been the rise of private brands that has been remarkable, steady and earned every step of the way. The steady growth has been marked by three eras that I describe as such:

The Age Of Value, Economy and No- Frills – this was the era where quality was fragile and unpredictable, and where price was the driver in every purchase. Packaging was barely a consideration and clumsy at best.

The Age Of Emulation And Quaility By Tier – this was an era where national brand quality was imitated, down to the spec, and comparisons were made abundantly clear. Tiering was stringently executed. Packaging and branding were being realized as drivers by some.

The Age Of Innovation – the era we are currently in, a time where retailers are trying to out-do each other on signature products that are uniquely designed and don’t live on the premise of pure emulation. Branding and product development (and the teams behind these missions) are the current drivers.

The Cumulative Effect Across Channels

There is a cumulative, positive effect of retailers across many channels that has changed consumers’ psyche, attitude and impression of Private Brands. Outliers like Trader Joe’s, Wegmans, HEB, and Sainsbury’s are still highly regarded and noticed for their exceptional own brands, but the “catching up” that other retailers have done, especially in alternate channels, is stunning and oddly helpful to the mission.

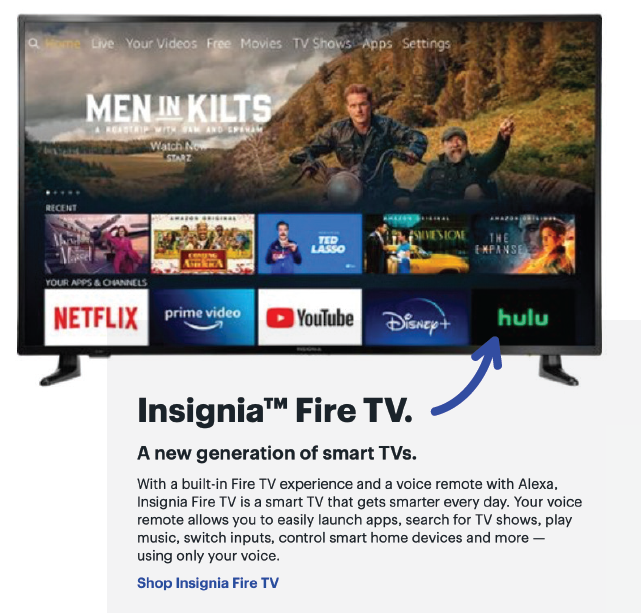

Best Buy & Technology

Best Buy is the largest electronics retailer in the U.S. (next to Walmart) and what they are doing in appliances, tv’s and home theater, and accessories is phenomenal with their own brand, Insignia. It is not some pallid imitator, no, it is a key media-forward part of their mission and is highly credible.

Williams-Sonoma, Innovation & Language

The premier cooking and culinary retailer, Williams Sonoma, has flirted with own brands over the years, but has recently taken their innovation to a new level. Throughout their cookware, bakeware, specialty foods, utensils and more there is a prominence, tech edge and credibility in their Willams Sonoma brand. In some cases like bakeware (and in advance of the holiday season) it is marketed in a dominant way, clearly explained and with innovation that is trademarked.

Recreation Equipment Incorporated (REI) & Outdoor Sports

REI is one of the premier outdoor sporting retailers, and they have a special set of Editor’s Choice awards every year, where products (all brands) are rigorously tested by category. In 2021 their REI trekking poles were rated the best, and in 2020 their Kingdom 6 tent also received an Editor’s Choice award. It is an objective test, it awards many established brands overall, but when an REI brand rises to the top, it creates real believability in their portfolio.

One great retailer is not creating the perceptual improvement and rise in a consumer’s psyche anymore, neither is one stand-out product, but it is the cumulative effect of retailers across many channels that has changed the psyche. Our psyche now treats private brands as credible, often innovative and far beyond anything that strictly lived in the Age Of Value, Economy & No-Frills (even though there are products that still linger from this era).

As we said, the consumer’s psyche is a weird thing, and in the case of private brands, the rise has been remarkable.

The Lessons

There are a few lessons in all of this that I think we can, as an industry, take to heart. The first is that what happens across channels matters and it can ironically have a positive effect on what you are trying to accomplish. Even though you may be in the grocery channel, what happens in Electronics, Culinary or Outdoor Sports retailing affects you. You can still be differentiated and shine in own brands versus your competitors, but how the consumer overall feels about them has a positive influence.

The second call to action is that at least once (and maybe twice) a year, you should take stock of what is happening in private brands through alternative channels. Create a one-day learning session, bring in an outside agency to conduct it for you, and brainstorm about the possibilities. There are cross-learnings from these other retailers and how they are approaching product and brand.

Finally, ensure that you are getting “credit” for the brands you market and create, whether it is literally through your retailer name (and packaging your own brands as such), or it is through the way you exclusively market them. But, to not get credit for your own brands today is a sin, and if they are hidden or are agnostic intentionally, like I see in some fashion and ecomm offerings, be careful. Private brands have seeped into the consumer’s psyche, it is not a relationship you need to hide, but rather be proud and take credit for the innovations and signatures you are creating.

Pery Seelert is a retail branding and marketing expert, with a passion for challenging conventional strategy and truths. He is the Strategic Partner and Co-founder of Emerge, a strategic marketing consultancy dedicated to helping Retailers, Manufacturers and Services grow exponentially and differentiate with purpose. Please contact Perry at perry@emergefromthepack.com