News from PLMA’s International Council reveal that Private Label brands continue to gain momentum across Europe, with total sales reaching €352 billion in 2024, according to data from NielsenIQ. This marks a 0.11 percentage point increase in market share from 2023, bringing private labels to 38.1% of the total grocery sector.

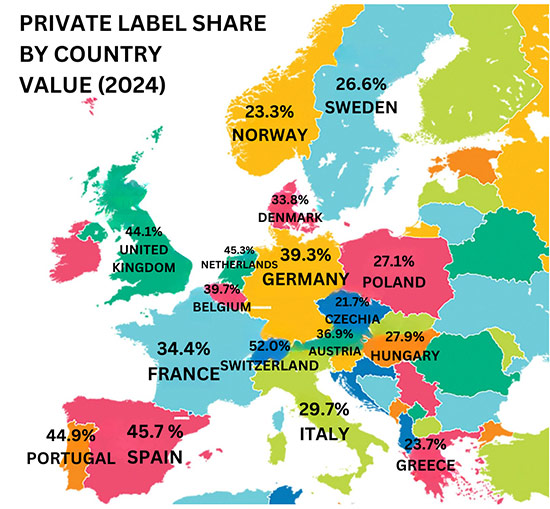

NielsenIQ’s survey, conducted across 17 European markets for PLMA’s 2025 International Private Label Yearbook, found that private label sales increased in nine out of the 17 countries. Europe remains a dominant global player in private label sales, with 10 countries exceeding a 30% market share of which five surpassing 40%. The region’s three largest grocery markets – Germany, the United Kingdom, and France – hold a collective private label share of 39.7%, reflecting a 0.1 percentage point increase from the previous year.

Among the highest-growing markets, Spain leads with a 1.2 percentage point increase in private label share, followed by the Czech Republic (+0.5 pp), Portugal (+0.4 pp), and France (+0.4 pp). Switzerland remains the strongest private label market, boasting a 52.0% share, making it the only country with a share above 50%.

Private Labels Drive Market Recovery

After a decline in unit volumes in 2023, the grocery market is showing signs of recovery, with total unit sales increasing by 1.27% in 2024, adding 5.24 billion units. Private labels have been the primary driver of this growth, contributing over 75% of the total increase, while manufacturers’ brands accounted for the remaining 25%.

Consumer perception of private labels continues to evolve, reinforcing their value proposition. A YouGov study indicates that shoppers have rated the price-performance ratio of private label products higher than in previous years. As a result, retailers with strong private label portfolios are gaining favour among price-conscious consumers.

Premiumization and Category Trends

Consumer attitudes toward private labels are shifting, leading to their transformation from budget-friendly alternatives to competitive, high-quality product lines. According to NielsenIQ, 50% of global consumers report an increased willingness to purchase private label products, and 40% say they would pay higher prices for them if they perceive superior quality. This trend reflects a growing “branding effect” in private labels.

Across product categories, private label growth is particularly strong in Ambient Food, Confectionery & Snacks, and Perishable Food, which collectively account for an average of 46.8% private label value share, representing €221 billion across the 17 tracked European markets. The highest growth within large markets (Germany, United Kingdom and France) was observed in Ambient Food and Alcoholic Beverages.

Spain and Portugal saw private label share gains of +1.1 percentage points, with Frozen Food growing by +2.0 percentage points. In contrast, Healthcare Private Label Share by Country Value (2024) and Pet Food saw slight declines in these regions. Belgium and the Netherlands experienced a minor -0.3 percentage point decline overall, but still showed growth in Healthcare, Ambient Food, Confectionery & Snacks, and Alcoholic Beverages. In Eastern Europe, private label share grew by +0.3 percentage points, led by Home Care, Perishable Food, and Ambient Food.

Scandinavian markets saw a slight -0.04 percentage point decline in private label share, mainly in Paper Products (-1.3 pp), Alcoholic Beverages (-0.2 pp), Frozen Food (-0.2 pp), Non-Alcoholic Beverages (-0.1 pp), and Ambient Food (-0.03 pp). However, growth was still visible in Health Care (+1.4 pp) and Health & Beauty (+0.4 pp).

Future Outlook

A recent PLMA industry survey among private label manufacturers and retailers found that nine out of 10 industry professionals expect private label sales to continue growing in the coming years. With evolving consumer preferences, strong price-performance value, and increasing premiumization, private labels are poised for continued expansion across European markets. According to NielsenIQ, total private label sales across the 17 European countries grew by €9.5 billion, reinforcing the sector’s resilience and growth potential in a competitive retail landscape.