By Perry Seelert

Insights around how they are thinking, where they want to lead, and ultimately how they want to differentiate their retail position versus others.

#1 Retailer CEO Issue: Omnichannel

The retailer Chief Executive Officer (CEO) has a twisted mind.

No, not twisted in a negative sense. Twisted with multiple strategic initiatives and changes that they and the industry must confront. It is a boiling pot of different things, each requiring its own priority and soft touch.

While these changes are becoming a lot more technologically driven, there is an air to politics that is also affecting the retail landscape. The CEO has to be the chief navigator to be effective, calculating the necessary investments along with the people and shopper strategies to get there, and of course, determine the speed of the pursuit.

What we will attempt to do here is give you a little insight into how many CEOs are thinking, and where they are placing their bets for the future. Own brands are an important facet to their overall thinking, but it is one of many things in the grand landscape of retail. The list of issues is not meant to be in order of priority. The intention is to inspire you and hopefully get you to think in broader terms about retailers’ future, what plagues them, and what the possibilities truly are.

As retailers talk about their omnichannel ambitions, their grandest of goals is to have a totally seamless shopping experience. What this means is giving consumers the ability to buy when, where and how it is most convenient for them.

The reason why they want seamlessness is all in the numbers really. They know that shoppers who are engaged both digitally and physically spend more and tend to be more loyal. In fact, Kroger reports that “customers who shop both in-store and on-line spend three to four times more compared to instore- only shoppers”. Today, 72% of all grocery sales of the omnichannel shopper is digitally influenced (grocerydoppio Q3, 2024), but the real value of digitally engaged consumers is that overall, they spend three times as much, are more loyal, and can drive growth across alternative profit ventures.

Kroger has a diversified omnichannel strategy, one that is rooted in a huge Ocado and fulfillment investment, and innovative ways to deliver in the final mile.

While grocers, club stores and mass merchants alike are embracing an omnichannel approach, Kroger is showing an incredible level of adoption and trying to find the balance between physical and digital.

Their Boost by Kroger Plus subscription service, direct delivery through autonomous and drone delivery experiments, Clicklist pick-up, no contact-payment solutions and their mobile app are all working to deliver this seamlessness that McMullen speaks of. And this cross-integration of shopping is proven out so far in that 90% of delivery and pick-up customers also shop in-store.

Walmart is also into omnichanel full-throttle, with 370 million products on their site (talk about dot.com product density), and 59 million members paying $98/year for Walmart+. With a $73 million ecommerce business and a stated goal of getting “most of America” on memberships, what Doug McMillon, CEO, says is…..

The proof is in the pudding with Walmart+ and unlimited delivery of over 160,000 products, integrated with other fuel, travel and RX ben-efits. Their delivery and click-and collect investments are significant, from 24 hour automated centers to MyQ in-garage delivery for Walmart+ customers.

The Clubs are also invested signifi-cantly in omnichannel, with perhaps BJ’s Wholesale putting the most energy and adoption around this initiative. They have made digital and omni a priority, which shows throughout their communication and results. They say about their digitally engaged members that they have “higher basket siz- es, more trips per year and the sheer number of digital members rose more than 400% on a 3 year stacked basis”.

The implications for omnichannel are enormous and boil down to who can get a competitive advan-tage in seamless omnichannel first? At what cost, where are the media implications, the SEO implications and is there ultimately a ceiling for digital and/or delivery?

#2 Retailer CEO Issue: Inflation, Tariffs & Trump

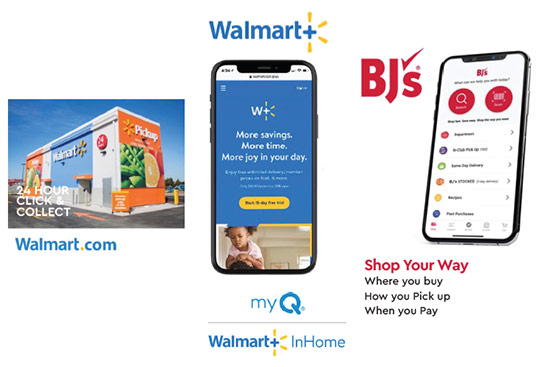

When inflation hit a 40 year high in June 2022, the prices for food had increased 10.4% (vs YAG) and Fortune 500 CEOs were calling inflation “the 800 pound gorilla in the room”. For many consumers and retailers twoand- a-half years later, inflation is still a beast. And while the inflation rate has decreased, it is still at historically high levels, and shoppers begrudgingly know that prices are not coming down soon, if ever.

As CEOs look at inflation, there is also the potential impact of threatened (or real) tariffs. These fall into one of three categories strictly from a U.S. perspective (at least as we write this today):

- Tariffs assigned to certain countries like Canada, Mexico and China

- Tariffs that are targeting product/ industry vertical specific like steel and aluminum

- Tariffs that are “reciprocal” as they were just talked about this February with India.

The impacts of these potential tariffs are ominous, and even if they are negotiating tactics, the uncertainty forces CEOs to look at their supply chains. It also forces CEOs to look at what they can control. Of course, there will be all sorts of retailer/supplier political lobbying to curry favor with President Trump, but in the end, retailers will want to exercise control where they can to contain costs and ensure continuity. This includes initiatives like:

- Deploying technology, analytics and AI

- Resetting labor allocation and scheduling

- Robotics and automation

- Inventory managment and supply chain productivity

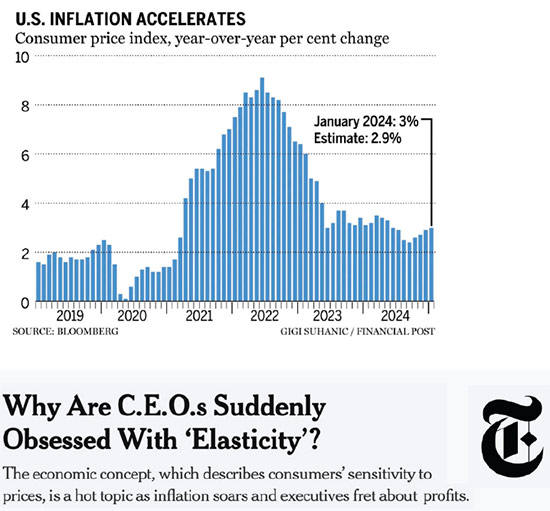

It also includes controlling your products and portfolio that you sell. Because along with the issue of inflation, is the coinciding concept of price elasticity. If you are a manufacturer you are asking “at what price will my consumer not buy my brand/product so much or switch?” If you are a retailer, elasticity implies “When will my shopper defect and go to a different channel or retailer?”

Inflation and elasticity are the reasons why you saw so many retailers either newly launch or reinforce their value brand strategies.

Asda’s Just Essentials, Waitrose’s Essentials, Kroger’s Smart Way are all demonstrated efforts to provide their shoppers with reasons to not drift to other channels. They are demonstrations of value, many with marketing attitude so that they don’t convey sterility, and they have legs into the future and staying power.

#3 Retailer CEO Issue: Fast Growth of My “Value Focused” Competitors

Retailer CEOs are putting intense focus on the three-pronged consumer conundrum: What are people buying, how much consumers are buying and WHERE are they buying it from?

This question of “where” is not just a question of buying within your channel of operation, but it is a question of cross-channel too, and how far someone is willing to defect and drift. Grocers are particularly afraid, with value pressure from clubs, value pressure from limited assortment and dollar operators, and value pressure from mass merchants. They might be most in the cross-hairs. But the growth of what once were “alternative” operators is now inescapable for the retailer CEO.

Dollar General (DG) is opening 575 stores in 2025 to their already 20,000+ in the U.S. There are only 2 U.S. states that don’t have a Dollar General (Alaska and Hawaii) and for many households, DG is their grocery store.

Aldi is the fastest growing U.S. grocery chain. They are going to open more than 225 stores in 2025, the most stores to be unveiled in one year during their 50-year history.

But it is not just the organic growth that is stunning that retailer CEOs are paying attention to, it is the shifting consumer they are attracting, and even as the Wall Street Journal has reported, bringing in the “one percenter”.

According to InMarket, not only is retailer foot traffic up in the share of dollar-store visits this last year among those making more than $100,000, but households with six-figure incomes say they are more likely to shop at dollar stores now. McKinsey has also reported on this one-percenter phenomenon and said that dollar stores are seeing an influx of wealthy consumers.

The “value” retailing sector and the consumer demographic it attracts cannot be looked at through the stereotypical lens. Today’s retailer CEO needs to look more broadly at who their competition is, beyond their own channel, and fight for value at every end of the consumer spectrum, even within the one-percenter segment.

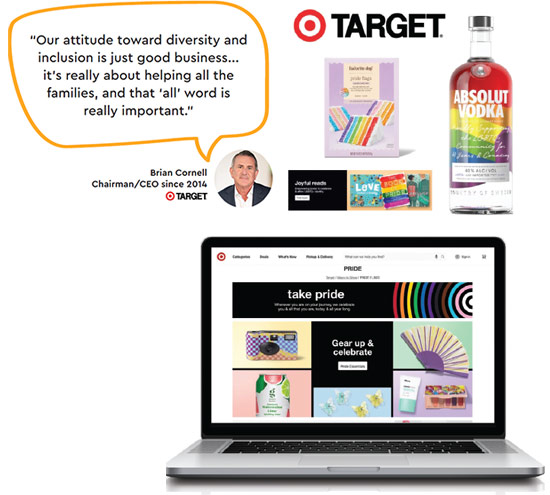

#4 Retailer CEO Issue: The Politics of Inclusion

DEI became especially political over the last year, and we are seeing a whiplash effect of retailer policies since President Trump was elected. It is a 180 degree turn like no other, and retailers like Target, Walmart and Amazon have all announced different approaches to DEI in the last 60 days.

In terms of messaging and even their approach to product portfolio, retailers are recalibrating. This is what Target said in mid-2023.

From a product perspective, their Pride collection at its height was near 2000 items in 2023 and is now around 75 items. Now this backlash happened before the U.S. election, but the scaling back of their DEI continues across the board today.

Many retailers prior to 2025 talked about the benefits of DEI, saying that it was a driving force in their business, inwardly for their own employees and outwardly for their communities and customers. Benefits many cited were team engagement, empowering their culture, recruiting and retention, and that it just made good human and business sense.

The “Open To All” initiative is a national nondiscrimination campaign based upon the idea that everyone is welcome regardless of race, ethnicity, national origin, sexual orientation, gender identity, immigration status, religion or disability. It was created to advance the DEI movement and it includes many leading retailers.

Where retailers find the right balance of DEI will be interesting to see in the next year, but there are many retailers and retailer CEOs who have not overreacted to the political winds. Costco has been notable in its resistance to changing DEI.

The North Face is another retailer who will likely be undeterred because they see DEI essentially as part of their DNA and brand. They have defended these stances before and I would guess that they will in the future too.

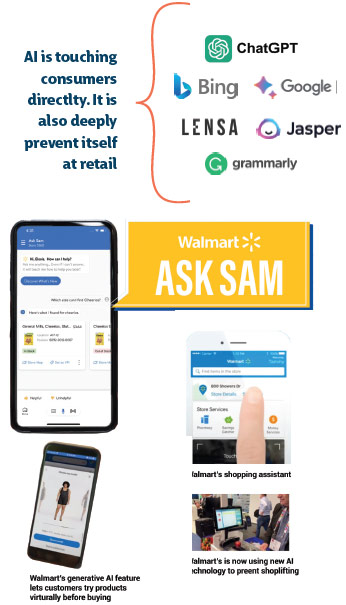

#5 Retailer CEO Issue: Artificial Intelligence

AI in retail is just touching the tip of the iceberg, and I believe the retailers who go all-in on AI through the supply chain, category analysis, marketing personalization and so much more will be advantaged. Many retail CEOs seem to believe this too.

AI is literally machine-led learning designed to act like human intelligence but involving data whose scale exceeds what humans can analyze. Its application at retail will be throughout the back and front-ends of operation. And, the early-adopting consumer is increasingly exposed to AI through everyday life.

Across all retail (maybe except for Amazon), Walmart has been one of the leading retailers in implementing AI, visibly to the consumer, visibly to their associates, and through the back end into the total supply chain.

Doug McMillon, CEO, is excited about what is possible with AI and says,

The presence of AI is seen in a number of ways – store associates have access to “Ask Sam”, customers have access to The Shopping Assistant and can also virtually see how furniture fits in a room, and AI is now embedded into selfcheckouts to control theft and help with scanning accuracy. In late 2023 Walmart gave 50,000 office workers a generative AI app, whereas other retailers have restricted it.

AI has a transformative power at retail with personalized advertising, delivery service applications (Instacart using ChatGPT), analyzing customer traffic patterns to optimize store layouts, managing warehouse operations, and so much more. The forward-thinking retail CEOs are talking about AI as a way to gain advantage with their shoppers and against their direct competitors.

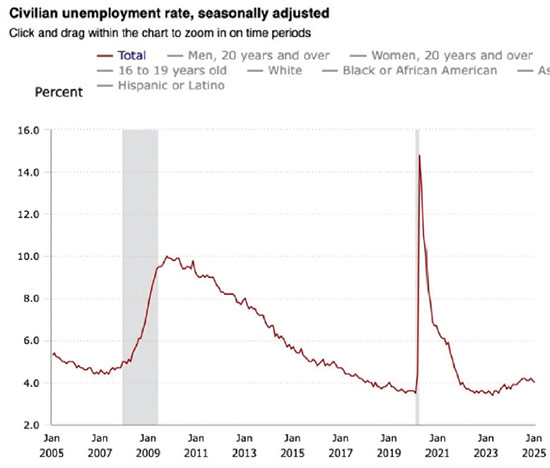

#6 Retailer CEO Issue: The Labor Market

You cannot be a retail CEO and not be obsessed with your workforce, who is your lifeblood. I mean let’s face it, companies like Kroger (with over 400,000 employees), Costco (333,000) and Walmart (2.1 M employees) depend on these vast teams to be differentiators, and with new stores constantly opening, these workforces are only growing. Costco’s workforce increased 5.38% YOY – the hunt for great people is always real.

Today, unemployment is 4.0%, which is still historically low (5.68% is the long-term average), meaning about 6.8 million people in the U.S. are not working. This still represents a relatively tight labor market.

Retail CEOs are observing that the types of skills necessary within retail are changing. Physical and manual skills are becoming less important, and technological skills are becoming more important. This trend will continue and it is part of the evolving talent model.

In the war for talent, retailers need to think about how they stem attrition by building a richer overall experience for their people. In a continued tight labor market this includes:

Considering higher wages that are made possible through other tech investments. This is the table stakes for retailers like Costco, who have always been more generous than many of their industry peers.

Reducing attrition with a better employee experience. There is often a disconnect between what employers and employees regard as important.

Planning talent needs over at least a three-year horizon and investing accordingly.

#7 Retailer CEO Issue: Automation

Automation surrounds us, and it definitely surrounds us at retail. It has become increasingly visible to the consumer, even if they are only seeing half of where it has actually manifested itself.

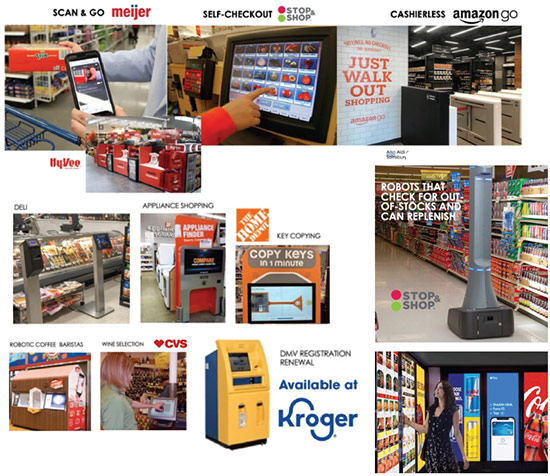

Retail CEOs see that there is a front-facing aspect of automation as well as a hidden one, and some are wrestling with the front-facing balance. At a retailer like Hy-Vee where their credo, known by all shoppers, is “a helpful smile in every aisle”, a personal, human touch is part of their DNA. However, even they have adapted and implemented many, many new technologies.

When we look at retailers’ checkout today, Catalina reports that 38% of all checkout lanes in the U.S. are automated (self), and the number of self-checkout lanes has increased by 10% in the last 5 years. There are three different automated ways to checkout today (scan & go, self-checkout and cashierless), and combined with AI (to reduce theft and check scanning accuracy), all can impact labor costs.

Cashierless has been experimented with and implemented by retailers like Amazon, Aldi and 7-11, and it relies heavily on facial recognition and motion sensors, to which some shoppers don’t think about and others perceive to be “invasive”.

We as consumers are getting used to seeing replenishment robots in-aisle. Stores are rife with in-store kiosks for the deli, wine selection, key-copying, DMV registration renewal, barista-made coffee and many other applications.

How much is too much is still an evaluation-in-progress, but consumers are increasingly embracing this automation. Though, the consumer is not shy when something doesn’t feel quite right.

These digital and interactive screens (like those in Walgreens) have been met with a lot of disdain.

Invisible automation (back-end and not seen by the consumer) is also implemented widely throughout the supply chain, and as said before, will continue. Retailers see this back-end automation as crucial for future efficiency and cost-savings.

Automation across retail will be tested, experimented with and implemented even more in the future, and the retail CEO knows that this type of investment (similar to AI in Retailer CEO Issue #5) will be a crucial lever for competitive advantage.

#8 Retailer CEO Issue: Ownability and Own Brands

Well, in a magazine that focuses globally on own brands, you might think it would be tough to exclude them from a “Retail CEO Top Ten Issues” list, and you would be right. But, own brands are here in the top ten on their own merit. CEO’s see them as a controllable, unique and differentiating asset in the retail warfare for the future.

The FMI reports often that “93% of retailers say private brands are very or extremely important to their business”, and almost all of them are boosting their investments. Yes, indeed, the retail CEO has own brands as part of their regular strategic thinking and part of their plan.

While I write about own brands often, there are three things today that stand out in looking at them, trends that a retailer CEO can take to heart.

- Being first matters when it comes to a unique product, and how you extend that differentiated attribute is important.

Costco was one of the first to bring unsulfured organic mangoes to market, a top-selling item. Other retailers saw this success, but only Kroger took the trend to other categories. The lesson here is try to be first, try to be different, and try to amplify the trend if you can.

Mango trend amplified to other categories - Dedicated, preemptive merchandising and marketing matter.

Sounds simple, but many retailers still skimp on space dedication for own brands. Look at how the clubs, in this case BJ’s, allocates space to own brands and allocates it towards their intended share objectives in a destination category.

When Wegmans gets behind a product/marketing idea, it is bolstered cohesively through every form of in-store and out-of-store media. - The rage for organic, natural and clean is real, and continued investment is essential.

Retailers and their CEOs see organic, natural and free-from as an important trend that will grow, and this is why you see them investing in product development.

#9 Retailer CEO Issue: Shrink, Theft & Urban Footprints

While this issue has quieted in the media, and to some degree, has actually quieted because of increased criminal prosecutions and many cities stepping up, this is still a major topic for retailers and their CEOs. Theft is real, it is a key determinant in shrink, and retailers are smartly (but sadly) actually building it into their planning.

The summer of ’23 was remembered as the height of criminal and organized flash mobs, and fashion retailers like Nordstrom’s were at the center of it all. This has the effect of actually frightening their core shoppers.

Stores lost $122 Billion in 2023 and many experts estimate that shoplifting could cost retailers $150+ Billion by 2026.

Ulta, the beauty care retailer, has responded to all of this by “increasing staffing, hiring, more security and using in-store fixtures to prevent theft. Fragrances, a frequent target of thieves, are locked in cabinets at 70% of Ulta’s stores nationwide,” says COO Kecia Steelman.

Walgreens still has beauty care and body care behind locked glass stores in many locations.

Whole Foods has notably been more cautious and pulled out of some key iconic locations, notably pulling back on San Francisco.

This issue has softened in the press, but it has not softened as retailers think about store and format planning, and the added investments in controlling theft/shrink within the boardroom.

#10 Retailer CEO Issue: Size and Mergers

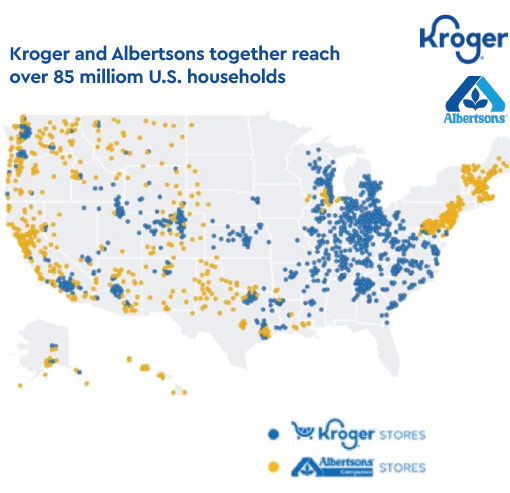

There have been some big mergers that have blown up as of late, and if you are a retailer CEO, you are thinking about what might be appropriate for your organization. Aldi and Southeastern Grocers has been largely dismantled after some Aldi store absorption, and the $25 Billion mega-merger between Albertsons and Kroger, which collectively cover 17% of all grocery has also been unwound.

This merger would have touched over 85 Million households in the U.S. Bain & Company has reported on this dip in mergers and said “we will see more retailers buying to diversify into higher-growth revenue streams – in some cases leveraging an existing asset that they’ve been sitting on (e.g., their data). They think that retailers could see as much as 40% of their revenue in “beyond trading” revenue and more than half of the industry’s profits by 2030.

If you are a retailer CEO and thinking about the prospect of mergers and acquisitions, what this means is that they will be more strategic potentially, and quieter from a customer facing point-of-view.

The Top 10 Issues Set Up an Excting Future

If you are a retailer CEO, you have a lot on your mind. A lot of priorities, and your people and investments need to be allocated judiciously. Even if you are not a retailer (and CEO) and are a manufacturer or service provider in the industry, it is often important to think like a CEO, knowing what is on your retail customer’s mind at the highest levels. Wishing you the best as you think about your individual initiatives and how to drive them in context of this overall bigger picture.

A retail branding and marketing expert, with a passion for challenging conventional strategy and truths. Perry is the Strategic Partner and Co-founder of Emerge, a strategic marketing consultancy dedicated to helping Retailers, Manufacturers and Services grow exponentially and differentiate with purpose.