By Perry Seelert

Own brands continue to evolve at a discernibly faster rate than CPG brands, but what does it all mean? What are the key areas of development, what is truly new, and where are the lingering bits of staleness?

If Darwin were still around to understand evolution as it applies to retailer brands he wouldn’t have believed it. They say evolution is unobservable. The process operates so slowly you cannot see it unless you have thousands of years of perspective. But what has happened over 50 years’ time in consumer packaged goods and own brands is astonishing, and even over the last decade, the dynamics that have led to retailer brand success are stunning.

We will start with three overarching areas of change that can be seen, and then we will shift the discussion to a little more micro look at what is more recently new in the industry, some of the catalysts for success, and the things still crying out for change.

Three Overarching Changes

There once was the idea in the own brand industry and across retailers that there were “taboo” categories that were untouchable. You might have been able to create a private brand product for a category, like an own brand wine, but certainly you would never launch it (or sell much of it).

What retailers now think is possible has expanded dramatically, and not only is every category for CPGs vulnerable and reachable, but the scale of own brands has changed in a major way, as well as the credibility that people now attach to them. These three overarching changes stand out more than any others in the retail brand world.

Nothing is Taboo Anymore

It used to be that own brand succeeded only across big commodities. Milk, bread, eggs were the primary domains for own brand success, and it was for one simple reason, that consumers perceived them as verifiably and certifiably the same as CPG brands. But no category is taboo in today’s own brand industry.

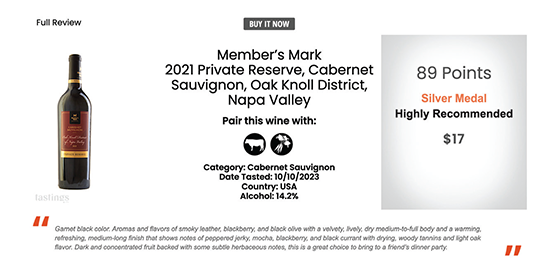

Some wines are receiving real accolades, especially those in the club channel. Personal care products like sun care used to be untouchable but now you see them in sprays, sticks, lotions, all types of SPF, clear, moisturizing, oxybenzone and paraben-free, reef-friendly, and many more.

Categories that have very distinct taste profiles like ketchup and mayonnaise used to engender the greatest brand and consumer loyalties, so they were not considered to be portfolio priorities. Think about Helmann’s or Best Foods mayonnaise or Heinz ketchup, retailers used to only half-heartedly offer own brands in these areas. This has changed too.

Kroger sells no HFCS ketchup and a Black Truffle variety in their Private Selection tier, and there are all types of Mayonnaise in different packaging configurations, flavors and varieties (including those made with Extra Virgin Olive Oil or egg-free/Vegan).

Personal care (sun care, skin care), baby care, alcohol, categories with distinctive taste profiles, household cleaning – they are not only reachable through own brands, but now we think about how they could topple what once were considered to be vaunted CPG brands.

The Tremendous Scale of Retailer Brands

Today, there are many retailers whose unit share in private brands is over ¼ of what they sell (Kroger, Walmart, Sam’s, HEB and Costco) and the elite with over 50% share (Wegmans). While share and penetration are interesting measures, I think what is astonishing is the sheer scale of certain retailer brands.

Costco’s Kirkland Signature brand sells over $60 billion annually, just let that sink in for a second. Kroger’s “Our Brands” total sales annually is around $30 billion. Comparatively speaking, one of the biggest CPG brands in the world, Coca Cola, generated $46 billion in annual revenue for 2023. Retailer brands and the categories where they are represented is throughout the four walls of the store, their penetration is often over ¼ of total sales, but it is the size of these brands that now commands everyone’s attention.

Establishing Credibility, Especially with New Consumers

The third larger, more overarching change with own brands is the degree to which they have established credibility, especially with younger generations of consumers. Now the most glaringly obvious and functional reason for increased credibility is the “quality” improvements over time with own brand. Consumers, at the product and brand’s core, must trust the quality, this is essential. However, there are three other drivers to establishing credibility:

One driver is purely in consumers’ experience, or lack of it, with private brands. Many Millennials, Gen Z and Gen Alpha, those who are born from the mid 1990’s and beyond don’t remember generics. They have no experiential baggage. In fact, the word “generics” makes little sense to them as they associate it maybe with drug products and not really food. They have no memory of some of the beginning growing pains of dreary “private label”.

The second driver in increasing credibility is in the improved visual language of own brands. The copycat language has to a large degree vanished, retailers have hired global design agencies, and the investment in custom imagery have all led to better impression. The strategy behind the design and the deft hand used to create it is a big part of gaining credibility, and we see this especially in English retail design.

The last driver in credibility has been the move from “last to first”. Own brands have not relegated themselves to follower status alone, but actually lead the creative product development process at some retailers. Look at Trader Joe’s and you will see launches, like their Everything But The Bagel spice, that preempted the leading CPG, McCormick, to market with this new product.

Beyond these three macro transformations, what have been the most recent changes we have seen in own brands?

One of the most recent sea changes we have seen in the industry is that a retailer’s scale does not determine its ability to foster great and expansive own brands. Even with the scale of Costco and Kroger as we refer to in the more macro transformations, the smaller retailer can still leverage the power and exclusivity of a great own brand program.

The Age of the Smaller Retailer Excelling in Own Brands

Smaller Retailers are not excluded from having unique and attractive own brands, in fact, it’s just the opposite today

It is amazing to see what smaller, more boutique and regional retailers have done with their own brands from a creative point of view. Rather than feeling like they don’t have the scale to attract suppliers, they actually see their scale as the reason they need to have unique, compelling products that have a point of difference versus their chain retail competitors.

FOXTROT

Retailers like Foxtrot with its 33 stores today and 50 planned openings this year is making own brands one of its differentiators. Through unique products, beautiful design and interesting limited-time collaborations, the Foxtrot portfolio is becoming a centerpiece for what they do and how they do it. Notice the incredible appetite appeal and impulse they create through salty snacks, beverages and frozen novelties

Sadly, Foxtrot ceased operating just before press time.

KOWALSKI’S

Kowalski’s Markets which covers 11 stores in the Minneapolis/St. Paul region also sees own brands as central to their distinction, and it shows in the way they develop new products, merchandise and market their brand. Categories like hummus are being disrupted by their own brand, which is small-batch and healthier than the big brands. They also write very intentional stories about their own brands using social media that educate consumers about their unique products.

Other smaller, boutique retailers like Dom’s Kitchen & Market in Chicago (which just merged with Foxtrot) and Dorothy Lane Markets in Dayton, Ohio are developing and marketing unique coffees, snacks, bakery and pantry items, sometimes locally-sourced and all creative in their purpose.

Marketing Investment, Marketing Prowess

The Marketing Investment for own brands by retailers continues to grow, and the influence and skill of their communications does too

The second more recent dynamic you can see in the own brand industry is that there is a more significant marketing investment retailers are making. The spend on own brands used to be a fraction of retailers’ overall marketing budget, but no longer. You see this in four important ways:

- Through television advertising

- Through continued celebrity/ endorsed exclusive brands

- Holiday and seasonal events that are own-brand focused

- The promotional calendar aimed at building shopper engagement

Wakefern/Shoprite in the New York area has supported their Bowl & Basket brand on television more than any other retailer’s own brand I have ever seen. It is a non-stop barrage of family-oriented, heart-warming and even humorous spots that all tie in the portfolio and message behind the Bowl & Basket brand. Six of them in total, which represents a real investment.

Walmart continues to invest in own brand marketing and exclusive brands with their celebrity tie-in to Drew Barrymore, who like Joanna and Chip Gaines at Target, has designed everything from kitchen appliances to housewares to furniture.

A third example of retailers’ more significant marketing for own brands is how they are doing it through seasonal events and holidays now. Marks & Spencer supports Easter through their M&S Collection brand, and their Easter Egg, chocolate, and candy portfolio, which is absolutely amazing. It gets significant press coverage, youtubers talk about it, and it is a true marketing event where own brand is the driver.

A fourth example that shows how retailers continue to invest in own brand marketing is through their promotional inventiveness, where the cost is largely in the ideation and not so much in the execution (if it is done through the social media you control). Take a current example happening at Trader Joe’s.

The idea is pretty simple, use 7 Trader Joe’s own brand products to make a pizza, snap a photo of it and tag it on social media with your recipe instructions and #TJsPizzaContest in your caption. There are literally thousands of entries, and it is this type of promotional creativity that generates engagement and interest around Trader Joe’s brands.

The Role of AI in Private Brands

If you are already sick of hearing about artificial intelligence, we are just getting started

There is a third more recent dynamic you can see just trickling into retailing and the potential for it to hit own brands is powerful and inevitable. You may be sick of hearing about AI, but its impact is already becoming real, and thus we have to mention it as a catalyst to more change we will be seeing in private brands.

FMI and grocerydoppio did a recent study about AI and its impact on the grocery industry from executives’ point of view. They predicted the following:

“The use of AI in grocery stores will grow by 400% by 2025”

- Executives believe this could eliminate 18% of store associates

- Eliminate 73% of store tasks

- Eliminate 53% of shopper inquiries

- Create $113 Billion in operational efficiency”

So how do we teach AI about the virtues of Private Brands and the importance they represent? How is AI handling private brand shopper inquiries?

How do we teach chat GPT when consumers ask for a “budget friendly meal for under $20” along with the recipe that they need to mention your private brand ingredients?

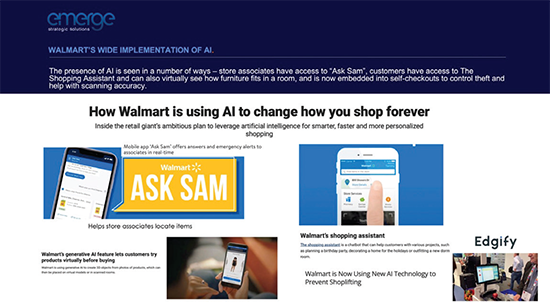

Walmart is already becoming an integrator and leader when it comes to AI, and they are embedding it across their corporate employees, in the stores, throughout the supply chain and in theft mitigation. It is only a matter of time before it gets more actively applied to assortment decisions and directly to private brands.

Kroger is implementing AI through their 84.51 data science division and combining forces with Microsoft Promote IQ to build out more personalized marketing and advertising (based upon what they know about their shoppers). AI is already getting implemented at retail, and the effect on own brands will be undeniable, so it is better to embrace this thinking now so that you stay ahead of the game.

Opportunities and Not Accepting Staleness

Yes, Darwin’s head would be spinning, because the own brand evolution and the catalysts behind the change have happened quickly overall. And even with all these positive developments, there are still some things that linger from the “old school”, that are symbols and evidence of past own brand approaches, that could be improved. Here is a rapid-fire list of some of the opportunities:

More modern trade shows that reflect our tremendous progress:

I have been attending the relevant trade shows domestically and globally for over 30 years, but there are some that have not kept modernizing and keeping up with rapid industry evolution. In fact, some venues have not changed, and the shows feel caught in time. Many of them need to really refresh their visual language, change the environment, they need to feel younger, fresher and more vibrant. Retailers have done this with their packaging and marketing (they have even done this with their people), but the shows feel a little formulaic and tired. Sorry, but these shows have an opportunity for a big re-think if we are to jolt into an era of artificial intelligence, ecomm, robotics, and rapidly changing retail.

Increasing an acceptable failure rate:

You heard that right, when it comes to new product launches and taking risks around your own brand program, retailers should acknowledge that there is an acceptable failure rate. We come from a copycat culture, which was all about the safety of imitating proven CPG successes, and thus there really were not many failures. Create a culture that allows a little more risk.

Destination development and the meaning of “destinations”:

The word “destination” gets thrown around a little too easily, and it is a legacy of the beginnings of category management over 30 years ago. A destination is big stuff, it is meaningful, it is truly differentiating, and it is not something that can be readily copied. Destinations should NOT be so transferrable from retailer to retailer. Target’s destinations should be really different than Walmart which are different than Costco and so forth. And if you have a destination, it is even better if own brands are central to the destination. Costco doesn’t just sell a $1.50 hot dog and soda, they sell a KIRKLAND SIGNATURE hot dog, and it just doesn’t translate well anywhere else. The message in all of this is create the destinations that are meaningful and distinct to your DNA.

Driving innovation is different than the CPG world:

Many retailers have imitated a lot of the innovation and arduous research process you see within big CPGs, and for sure, retailers’ private brand departments needed more of that. However, it is also important to leave a little room for invention, intuition and reacting to trends more quickly. When Dave Nichol created President’s Choice at Loblaw he (and then ultimately a team) travelled the world, used their culinary sensibilities and invented with some hyperbole. Decadent cookies, Memories sauces, a cola that competed against Coca-Cola. This boldness would have never happened if there wasn’t a little room left for risk (and yes, failure), speed of implementation, and intuition.

We Really Are Evolving Faster and Better

Three Overarching Transfpormations::

- No category is taboo anymore

- Scale that exceeds the biggest CPG brands

- Consumer credibility

More Recent Changes:

- The power of the smaller retailer

- Continued marketing prowess

- The looming impact and integration of AI

Opportunities:

- Modernizing the shows that represent us

- Accepting more risk/failure

- Pushing for unique destinations

- Driving innovation with more degrees of freedom

“Change is at the very core of evolution and without it, all creatures would look alike and behave the same way.” [attributed to Martin Dansky]

I like to think the change in the own brands world we have seen in a mere 50 years is astounding, and it is exciting to think that there is more to follow.

Perry Seelert is retail branding and marketing expert, with a passion for challenging conventional strategy and truths. He is the Strategic Partner and Co-founder of Emerge, a strategic marketing consultancy dedicated to helping Retailers, Manufacturers and Services grow exponentially and differentiate with purpose. Please contact Perry at [email protected].